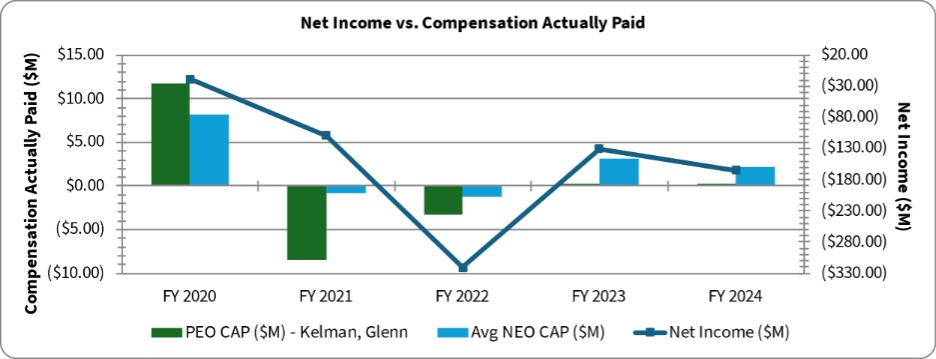

(5) Net income as reported in the Company’s audited financial statements.

(6) We determined Adjusted EBITDA to be the most important financial performance measure used to link Company performance to Compensation Actually Paid to our PEO and Non-PEO NEOs in 2024. Adjusted EBITDA is a non-GAAP financial measure. Please see “Segment Financial Information” in our Annual Report on Form 10-K for more information on Adjusted EBITDA, including a reconciliation to Net Loss. Adjusted EBITDA for 2024, 2023, 2022 and 2021 are all continuing operations due to the wind-down of RedfinNow. Adjusted EBITDA for 2020 is consolidated and includes RedfinNow, since we did not distinguish between continuing and discontinuing operations. We may determine a different financial performance measure to be the most important financial performance measure in future years.

Analysis of the Information Presented in the Pay Versus Performance Table

In this section, we provide a graphic analysis showing a comparison of the compensation actually paid to executives and total shareholder return, net income and Adjusted EBITDA. The “compensation actually paid” is calculated in accordance with the methodology described above.

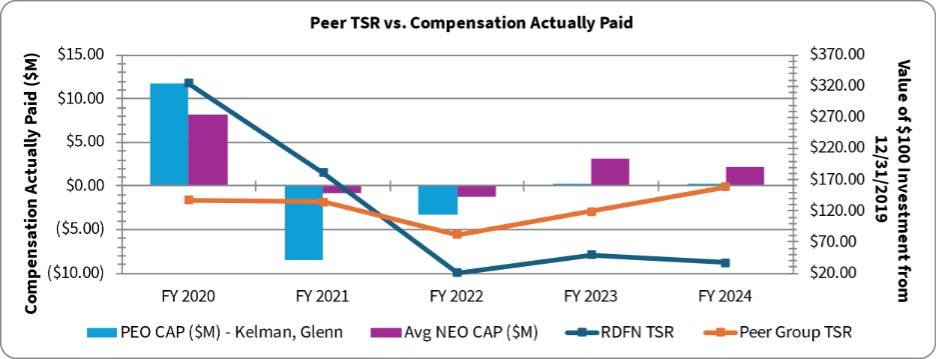

Description of Relationship Between PEO and Non-PEO NEO Compensation Actually Paid and Company Total Shareholder Return (“TSR”) and Peer Group TSR

The following chart sets forth the relationship between compensation actually paid to our PEO, the average of compensation actually paid to our Non-PEO NEOs, and the Company’s cumulative TSR and the RDG Composite Index cumulative TSR over the five most recently completed fiscal years.

25