|

| |

UNITED STATES |

SECURITIES AND EXCHANGE COMMISSION |

Washington, D.C. 20549 |

|

Schedule 14A Information |

|

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 |

(Amendment No. ) |

|

þ Filed by the Registrant | ¨ Filed by a Party other than the Registrant |

|

| |

Check the appropriate box: |

¨ | Preliminary Proxy Statement |

¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

þ | Definitive Proxy Statement |

¨ | Definitive Additional Materials |

¨ | Soliciting Material under § 240.14a-12 |

Redfin Corporation |

(Name of Registrant as Specified In Its Charter) |

|

| | |

Payment of Filing Fee (Check the appropriate box): |

þ | No fee required |

¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

¨ | Fee paid previously with preliminary materials. |

¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

April 25, 2019

Dear Redfin Stockholder,

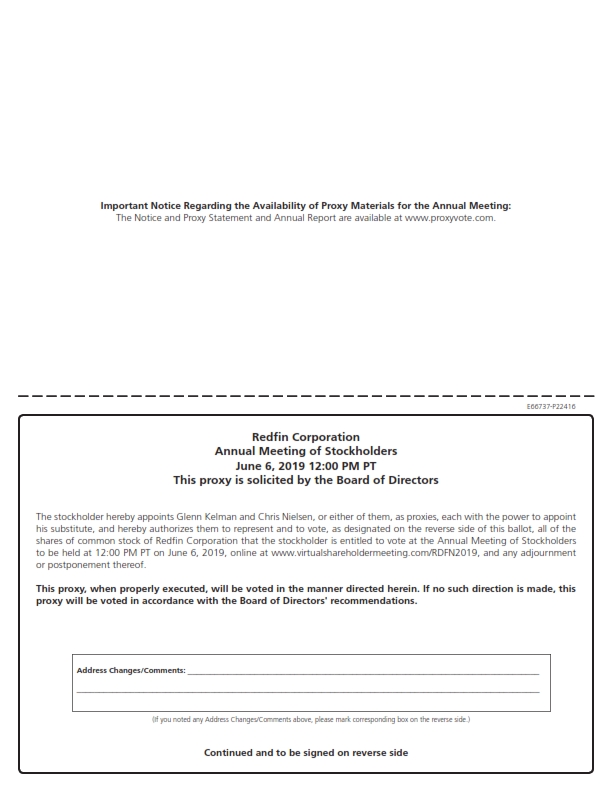

We invite you to attend Redfin Corporation's 2019 Annual Meeting of Stockholders to be held on Thursday, June 6, 2019 at 12:00 p.m. Pacific Time. This will be a virtual meeting conducted online via a live webcast. You will be able to attend the meeting, submit your questions and comments during the meeting, and vote your shares at the meeting by visiting www.virtualshareholdermeeting.com/RDFN2019.

You are receiving this proxy statement and the accompanying proxy materials because you were a Redfin stockholder as of April 9, 2019, which is the record date for the annual meeting, and are eligible to vote at the meeting. During the meeting, you will be able to access, through the website for the meeting, a list of stockholders entitled to vote. Please use this opportunity to participate in Redfin’s affairs by voting on the matters described in this proxy statement.

Whether or not you plan to attend the annual meeting, your vote is very important, and we encourage you to cast your ballot as soon as possible in one of the ways outlined in this proxy statement.

Sincerely,

Robert Mylod, Jr.

Chairman of the Board

Table of Contents

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING

| |

1. | Why did I receive this proxy statement and other materials related to the annual meeting? |

Each person who owned any shares of our common stock as of the close of business on April 9, 2019, or the record date, is entitled to vote at the annual meeting. You are receiving this proxy statement and accompanying proxy materials because you can vote at the meeting and our board of directors is soliciting your proxy to vote. The materials describe the matters to be voted on at the meeting and provide you with other important information so that you can make informed decisions. Please review the materials before casting your vote.

We delivered this proxy statement and other meeting materials to our stockholders eligible to vote on or around April 25, 2019.

| |

2. | When is the annual meeting? |

We will start the meeting at 12:00 p.m. Pacific Time on Thursday, June 6, 2019.

| |

3. | How do I attend the annual meeting? |

The meeting will be a virtual meeting conducted online via a live webcast, and you can attend by visiting www.virtualshareholdermeeting.com/RDFN2019 from anywhere with access to the Internet and a web browser. Shortly before the meeting's start time, please visit the meeting's website and log in using your control number. See question 17 for where to find your control number. If you encounter any difficulties accessing the meeting, please call the technical support number that will be posted on the log in page of the meeting's website.

| |

4. | What are the matters to be voted on at the annual meeting? |

You are being asked to vote on the following:

| |

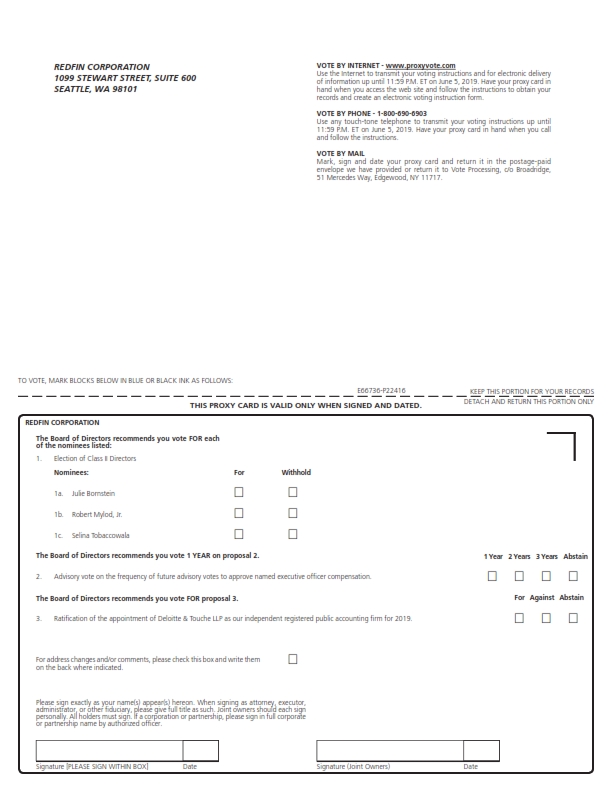

1. | The election of Julie Bornstein, Robert Mylod, Jr., and Selina Tobaccowala to our board of directors as Class II directors. |

| |

2. | The frequency of future non-binding votes on our named executive officers' compensation, on an advisory basis. |

| |

3. | The ratification of our audit committee's appointment of Deloitte & Touche LLP as our independent registered public accounting firm for 2019. |

While we do not expect any other matter to be voted on at the meeting, the proxy holders will have discretionary authority to vote shares represented by a returned proxy on any additional matter that is presented for a vote at the meeting.

| |

5. | What are my choices in voting on each matter? How does the board of directors recommend that I vote? |

|

| | | | | | | | |

| Proposal number | | Item | | Voting choices | | Board recommendation | |

| 1 | | Election of directors | | For(1) Withhold(1) | | For(1) | |

| 2 | | Frequency of future non-binding votes on our named executive officers' compensation | | 1 Year 2 Years 3 Years Abstain | | 1 Year | |

| 3 | | Ratification of appointment of auditor | | For Against Abstain | | For | |

(1) The voting choices and board recommendation are with respect to each Class II director nominee.

| |

6. | What vote is required to approve each matter? How do abstentions and broker non-votes affect approval? |

|

| | | | | | | | | | |

| Proposal number | | Item | | Votes required for approval | | Abstentions | | Broker non-vote(1) | |

| 1 | | Election of directors | | Plurality of votes present and entitled to vote | | Not applicable | | No effect | |

| 2 | | Frequency of future non-binding votes on our named executive officers' compensation(2) | | Majority of votes cast(3) | | No effect | | No effect | |

| 3 | | Ratification of appointment of auditor | | Majority of votes cast | | No effect | | Not applicable | |

(1) A broker non-vote occurs when a beneficial holder does not provide specific voting instructions to its broker or nominee and the broker or nominee does not have discretionary authority to vote the shares. Brokers and nominees do not have discretionary authority to vote uninstructed shares with respect to proposals 1 and 2 but do have discretionary authority to vote uninstructed shares with respect to proposal 3. Please see question 18 to determine if you are a beneficial holder.

(2) Proposal 2 is an advisory vote, which means that our stockholders' vote outcome is not binding. However, we value our stockholders' opinions and will consider the outcome of the vote when deciding the frequency of future non-binding votes on our named executive officers' compensation.

(3) If no selection receives a majority of votes cast, then the selection that receives a plurality of votes present and entitled to vote will be deemed to be our stockholders' recommendation on the frequency of future non-binding votes on our named executive officers' compensation.

| |

7. | How many votes does each share represent? |

Each share of our common stock represents one vote. As of the record date, we had 90,967,942

shares outstanding.

You may vote before the meeting through any of the following methods:

| |

• | By Internet: visit www.proxyvote.com |

| |

• | By telephone: call 1-800-690-6903 (if you are a record holder) or 1-800-454-8683 (if you are a beneficial holder) |

| |

• | By mail: complete, date, and sign your proxy card (if you are a record holder) or voting instruction form (if you are a beneficial holder) and return it in the postage-paid envelope |

Internet and telephone voting are available 24 hours a day and will close at 11:59 p.m. Eastern Time on June 5, 2019. If you are voting by mail, please return your proxy card or voting instruction form in a timely manner to ensure it is received by us or your broker or nominee, respectively, before the meeting. Please see question 18 to determine if you are a record holder or a beneficial holder.

You may also vote at the meeting through the website www.virtualshareholdermeeting.com/RDFN2019. Even if you intend to attend and vote at the meeting, we strongly encourage you to vote before the meeting using one of the methods described above.

To vote through any of the methods described above, you will need your control number. See question 17 for where to find your control number.

| |

9. | How can I revoke my proxy or change my vote? |

If you are a record holder, you can revoke your proxy by delivering a notice to our principal executive offices stating that you are revoking your proxy. This revocation is valid only if we receive your notice before the meeting. Please see question 19 for the address of our principal executive offices.

If you are a record holder, you may change your vote before the meeting by submitting a later-dated proxy through any of the methods described under question 8. You do not need to deliver the later-dated proxy using the same method as the original proxy.

If you are a beneficial holder, please contact your broker or nominee for the procedures on revoking your proxy or changing your vote before the meeting.

Both record holders and beneficial holders may change their vote by attending the meeting and voting at the meeting. Your attendance at the meeting, alone, will not revoke your proxy.

Please see question 18 to determine if you are a record holder or a beneficial holder.

| |

10. | Can I ask questions or make comments during the annual meeting? |

If you were a stockholder as of the record date, you will be able to submit questions and comments through the annual meeting's website. To ask a question or make a comment, you will need to log into the meeting using your control number. See question 17 for where to find your control number. Time permitting, we will read every appropriate question or comment and, if necessary, respond to it. Examples of inappropriate questions or comments include those about personal concerns not shared by our stockholders generally or those that use offensive language. We will address questions and comments in the order in which they were received but with priority for stockholders who have not previously submitted a question or comment during the meeting. A replay of the meeting, including the questions and answers portion, will be available on the meeting's website through June 5, 2020.

| |

11. | Who will bear the cost of the solicitation of proxies by our board of directors? |

Redfin will bear the cost of the solicitation.

| |

12. | What is the deadline for submitting a stockholder proposal to be presented at the 2020 annual meeting of stockholders? |

If you wish to submit a stockholder proposal for inclusion in Redfin’s proxy materials for the 2020 annual meeting, then we must receive your proposal at our principal executive offices no later than December 27, 2019. Please review the SEC’s Rule 14a-8 for the requirements you must meet and the information you must provide if you wish to submit this type of stockholder proposal.

For other types of stockholder proposals to be presented at the 2020 annual meeting, you must deliver notice of your intent to submit a proposal to our principal executive offices no earlier than the close of business on February 22, 2020 and no later than the close of business on March 23, 2020. Please review our bylaws for the requirements you must meet and the information you must provide if you wish to submit a proposal under this process.

Please see question 19 for the address of our principal executive offices.

| |

13. | What is the deadline for nominating a person for election as a Class III director at the 2020 annual meeting of stockholders? |

You must deliver notice of your intent to nominate a Class III director candidate to our principal executive offices no earlier than the close of business on February 22, 2020 and no later than the close of business on March 23, 2020. Please review our bylaws for the requirements you must meet and the information you must provide if you wish to nominate a person for election.

Please see question 19 for the address of our principal executive offices.

| |

14. | I share an address with one or more other stockholders. Why did we receive only one set of annual meeting materials? |

We have utilized an SEC rule that permits us to deliver one set of annual meeting materials to multiple stockholders sharing an address. However, if each stockholder at the shared address would like to receive separate copies of the materials, then we will deliver promptly the additional copies upon written or oral request.

If you are a record holder, you can make a request by delivering a notice to Broadridge Financial Solutions, Inc. at 51 Mercedes Way, Edgewood, New York 11717, Attention: Householding Department or by calling 1-866-540-7095.

If you are a beneficial holder, please contact your broker or nominee for instructions on how to receive separate copies of the materials.

Please see question 18 to determine if you are a record holder or a beneficial holder.

| |

15. | I share an address with one or more other stockholders and we each received separate copies of the annual meeting materials. Can we receive only one set of materials for future meetings? |

Yes. If you are a record holder, please make a request by contacting Broadridge Financial Solutions at the address or phone number provided in question 14. If you are a beneficial holder, please contact your broker or nominee for instructions on how to receive one set of materials for future meetings.

Please see question 18 to determine if you are a record holder or a beneficial holder.

| |

16. | How can I receive proxy materials for future annual meetings electronically? |

To sign-up for email notification and electronic delivery of proxy materials for our future annual meetings, please visit enroll.icsdelivery.com/RDFN.

| |

17. | Where can I find my control number? |

Your control number is the sixteen-digit number found next to the label "Control Number" in the body of your email, if you received email notification, or your proxy card, voting instruction form, or notice of Internet availability of proxy materials, if you received paper notification.

| |

18. | Am I a record holder or a beneficial holder? What is the difference? |

If the shares that you own are registered in your name with American Stock Transfer & Trust Company, our transfer agent, then you are a record holder of our shares and can vote your shares directly. If the shares that you own are registered in the name of a broker or other nominee, then you are a beneficial holder of our shares and must instruct your broker or nominee on how to vote your shares. See question 8 for how to vote your shares or provide voting instructions to your broker or nominee. If you are a beneficial holder and your broker or nominee does not receive instructions from you, then it may lack discretion to vote your shares, as described in question 6.

| |

19. | What is the mailing address for Redfin’s principal executive offices? |

The mailing address for our principal executive offices is 1099 Stewart Street, Suite 600, Seattle, WA 98101, Attention: Legal Department.

PROPOSAL 1 - ELECTION OF DIRECTORS

Our board of directors consists of eight directors and is divided into three classes, designated as Class I, Class II, and Class III. Directors in Class II are standing for election at the annual meeting, while directors in Class III and Class I will stand for election at the 2020 annual meeting and 2021 annual meeting, respectively.

Our board of directors, upon the recommendation of our nominating and corporate governance committee, has nominated Julie Bornstein, Robert Mylod, Jr., and Selina Tobaccowala for election as Class II directors. For more information about each Class II director nominee, including why we believe each nominee is qualified to serve as a director, see "Class II Director Nominees" below. If a Class II director nominee is unable to serve, or for good cause will not serve, as a director, then the proxy holders will vote a returned proxy for the election of a substitute nominee who is proposed by our board of directors. If elected at the meeting, the Class II directors will serve until the 2022 annual meeting and until his or her successor is elected and qualified, or, if earlier, his or her resignation or removal.

We evaluated the independence of our directors based on the listing standards of The Nasdaq Global Select Market, which is where our common stock is listed, and concluded that each director, other than Glenn Kelman, is independent.

Class II Director Nominees

Julie Bornstein, age 49, has been one of our directors since October 2016. Since February 2018, Ms. Bornstein has been Chief Executive Officer at Zipper (an e-commerce marketplace), which she also founded. Previously, Ms. Bornstein was Chief Operating Officer at Stitch Fix (an online personal styling services company) from March 2015 to September 2017 and Chief Marketing Officer & Chief Digital Officer at Sephora (a personal care and beauty company) from August 2007 to March 2015. Ms. Bornstein is also currently on the board of directors of Weight Watchers International. Ms. Bornstein has a bachelor's degree from Harvard University and an MBA from Harvard Business School. We believe that Ms. Bornstein's senior leadership experience at various online services companies qualifies her to serve on our board of directors.

Robert Mylod, Jr., age 52, has been one of our directors since January 2014 and our Chairman since August 2016. Since January 2012, Mr. Mylod has been a managing partner at Annox Capital (a venture capital firm). Previously, Mr. Mylod served several roles at The Priceline Group (n/k/a Booking Holdings), including Vice Chairman, Chief Financial Officer, and Head of Worldwide Strategy. Mr. Mylod's current public company directorships include Booking Holdings and Dropbox, while some of his past public company directorships include EverBank Financial, NovoCure, and Autobytel (n/k/a AutoWeb). Mr. Mylod has a bachelor's degree from the University of Michigan and an MBA from the University of Chicago Booth School of Business. We believe that Mr. Mylod’s experience as a venture capital investor and a senior finance executive, including as the chief financial officer of a large publicly traded online services provider, qualifies him to serve on our board of directors.

Selina Tobaccowala, age 42, has been one of our directors since January 2014. Since April 2016, Ms. Tobaccowala has been Chief Executive Officer at Gixo (a fitness company), which she also co-founded. Previously, Ms. Tobaccowala was President and Chief Technology Officer at SurveyMonkey (an online survey development company) from October 2009 to April 2016, Senior Vice President of Product & Technology at Tickemaster Europe from March 2005 to October 2009, and Vice President of Engineering at Evite.com, which she also co-founded, from April 1997 to April 2001. Ms. Tobaccowala has a bachelor's degree from Stanford University. We believe that Ms. Tobaccowala’s technology background and senior leadership experience at multiple online services companies qualifies her to serve on our board of directors.

Class III Continuing Directors

Robert Bass, age 69, has been one of our directors since October 2016. Mr. Bass has been a director at Apex Tool Group since December 2014 and was a partner at Deloitte & Touche from 1982 to 2012, including serving as Vice Chairman from 2006 to 2012. Mr. Bass's current public company directorships include Groupon and the Blackstone / GSO Secured Lending Fund, while some of his past public company directorships include Sims Metal Management and NewPage Holdings. Mr. Bass has a bachelor's degree from Emory University and an MBA from the Columbia University Graduate School of Business. We believe that Mr. Bass’s knowledge of public company financial reporting and accounting and his accounting firm leadership experience qualifies him to serve on our board of directors.

Glenn Kelman, age 48, has been one of our directors since March 2006. Since September 2005, Mr. Kelman has been our President and Chief Executive Officer. Previously, Mr. Kelman was Vice President of Marketing and Product Management at Plumtree Software, which he also co-founded. Mr. Kelman has a bachelor's degree from the University of California at Berkeley. We believe that Mr. Kelman’s deep understanding of our company and his real estate industry experience qualifies him to serve on our board of directors.

Class I Continuing Directors

Austin Ligon, age 68, has been one of our directors since September 2010. Since 2006, Mr. Ligon has been a venture investor. Previously, Mr. Ligon served as President and Chief Executive Officer at CarMax, which he also co-founded. Mr. Ligon has bachelor's and master's degrees from the University of Texas at Austin and an MBA from the Yale School of Management. We believe that Mr. Ligon’s experience scaling and managing CarMax from startup to nationwide operations, with extensive online presence and nationally distributed field operations, qualifies him to serve on our board of directors.

David Lissy, age 53, has been one of our directors since February 2018. Since January 2018, Mr. Lissy has been a director and Executive Chairman of Bright Horizons Family Solutions (a publicly traded child care company), where he was also Chief Executive Officer from 2002 to January 2018. Mr. Lissy is also a director of Jumpstart and chair of the board of trustees of Ithaca College, where he received his bachelor's degree. We believe that Mr. Lissy’s experience leading a publicly traded company, as both a director and an executive officer, qualifies him to serve on our board of directors.

James Slavet, age 49, has been one of our directors since November 2009. Since April 2006, Mr. Slavet has been a partner of Greylock Partners (a venture capital firm). Previously, Mr. Slavet was Vice President / General Manager in Search & Marketplace at Yahoo! from April 2004 to April 2006 and Chief Operating Officer at Guru, which he also founded, from June 1999 to April 2003. Mr. Slavet has a bachelor's degree from Brown University and an MBA from Harvard Business School. We believe that Mr. Slavet’s experience advising and managing growth-oriented technology companies, including as an operating executive, qualifies him to serve on our board of directors.

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF EACH CLASS II DIRECTOR NOMINEE.

INFORMATION REGARDING OUR BOARD OF DIRECTORS AND ITS COMMITTEES

Board Meetings and Annual Meeting Attendance

During 2018, our board of directors held seven meetings and acted by unanimous written consent twice. Each director attended at least 75% of the meetings of our board and each committee on which the director served.

Our policy is to invite and encourage each director to be present at our annual meeting. Each person serving as a director at the time of our 2018 annual meeting attended the meeting.

Communicating with our Board of Directors

For instructions on how to communicate with our board of directors or specific individual directors, please see our Corporate Governance Guidelines available under the "Governance" section of our investor relations website located at investors.redfin.com.

Committees of our Board of Directors

Our board of directors has established an audit committee, a compensation committee, and a nominating and corporate governance committee. Please see below for information regarding each committee.

Each committee operates under a written charter that outlines the committee’s duties and responsibilities. Each committee periodically reviews and updates, as necessary, its charter to reflect the committee's evolving role. You can obtain the charter for each committee in the “Governance” section of our investor relations website at investors.redfin.com.

|

| |

Audit Committee |

Members | • Robert Bass (Chair)* • Austin Ligon • Robert Mylod, Jr. |

| |

2018 activity | • Held 10 meetings • Acted by unanimous written consent once |

| |

Responsibilities | • Review and discuss with management our quarterly and annual financial results and the related earnings releases and earnings guidance distributed to the public • Discuss with management and our independent auditors the selection, application, and disclosure of critical accounting policies and practices • Review and discuss with management and our independent auditors their periodic reviews of the adequacy and effectiveness of our accounting and financial reporting processes and systems of internal control, including any significant deficiencies and material weaknesses in their design or operation • Be directly responsible for the appointment, compensation, retention, oversight and, if appropriate, replacement of our independent auditors |

* Our board of directors has determined that Mr. Bass qualifies as an “audit committee financial expert,” as the SEC has defined that term.

|

| |

Compensation Committee |

Members | • James Slavet (Chair) • Selina Tobaccowala |

| |

2018 activity | • Held two meetings • Acted by unanimous written consent seven times |

| |

Responsibilities | • Annually review our overall compensation strategy, including base salary, incentive compensation, and equity-based compensation, to assure that it promotes stockholder interests and supports our strategic and tactical objectives • Annually review and approve all cash-based and equity-based incentive compensation plans and arrangements • Review all director compensation and benefits for service on our board and committees and recommend to our board the form and amount of director compensation |

|

| |

Nominating and Corporate Governance Committee |

Members | • Julie Bornstein (Chair) • Robert Bass |

| |

2018 activity | • Held one meeting • Acted by unanimous written consent twice |

| |

Responsibilities | • Develop and recommend policies regarding our director nomination process • Identify, evaluate, and select, or recommend that our board selects, nominees for election or appointment to our board • Periodically review and assess the adequacy of our compliance policies and recommend any proposed changes to our board |

Director Nomination Process

Our nominating and corporate governance committee is responsible for identifying and evaluating director nominees. When evaluating a candidate, the committee considers his or her qualifications, expertise, diversity, and experience in totality, without targeting specific qualities or skills or requiring minimum qualifications. With respect to diversity, the committee does not maintain a formal, written policy on considering diversity in identifying nominees, but it may consider differences of viewpoint, professional experience, education, skill set, and other unique qualities and attributes that contribute to heterogeneity across our board of directors, including characteristics such as race, gender, and national origin.

Our nominating and corporate governance committee will consider director candidates recommended by our stockholders. The committee will evaluate a stockholder-recommended candidate in the same manner as other candidates, as described above. Stockholders who wish to recommend a candidate for the committee to consider should send us information regarding the candidate by email to ir@redfin.com or by hardcopy to 1099 Stewart Street, Suite 600, Seattle, WA 98101, Attention: Corporate Secretary.

Risk Oversight

Our board of directors, as a whole, has responsibility for risk oversight, and each committee of our board of directors oversees and reviews risk in areas that are relevant to it. The risk oversight responsibility of our board of directors and its committees is supported by our management reporting processes, which are designed to provide visibility to our board and to our personnel who are responsible for risk assessment, information about the identification, assessment, and management of critical risks.

Along with our management, our audit committee is responsible for reviewing our major financial and cybersecurity risk exposures while our compensation committee is responsible for reviewing our major compensation-related risk exposures. For each risk area, the applicable committee and our management are also responsible for reviewing the steps we have taken to monitor or mitigate any identified exposures. We believe that our current compensation practices do not create risks that are reasonably likely have a material adverse effect on us.

Audit Committee Report

Redfin’s management has primary responsibility for preparing the company’s consolidated financial statements and for its financial reporting process. The audit committee has reviewed, and discussed with management, Redfin’s audited consolidated financial statements for the year ended December 31, 2018. The audit committee provides the company’s board of directors with the information and materials the committee deems necessary to make the board aware of financial matters requiring the attention of the board. The audit committee also meets in executive sessions, without the presence of the company’s management, with Deloitte & Touche LLP, the company’s independent registered public accounting firm. The audit committee has discussed with Deloitte & Touche LLP the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board and the Securities and Exchange Commission.

The audit committee has received the written disclosures and the letter from Deloitte & Touche LLP required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent accountant’s communications with the audit committee concerning independence, and has discussed with Deloitte & Touche LLP its independence.

Based on the review and discussions referred to above, the audit committee recommended to the board of directors that the audited consolidated financial statements for the year ended December 31, 2018 be included in Redfin’s annual report on Form 10-K for the year ended December 31, 2018 for filing with the Securities and Exchange Commission.

Robert Bass

Austin Ligon

Robert Mylod, Jr.

Director Compensation

Our board of directors establishes our directors' compensation based on the recommendation of our compensation committee. We compensate our non-employee directors with a combination of cash and equity, in the form of restricted stock unit, or RSU, awards. James Slavet is a managing member of an affiliate of Greylock Partners and has an arrangement with Greylock Partners pursuant to which the cash compensation due to him is paid directly to Greylock Partners. Glenn Kelman, our President and Chief Executive Officer, also serves as a director. We compensate Mr. Kelman solely for serving as our President and Chief Executive Officer – see “Executive Compensation” below – and do not provide additional compensation for his service as a director. The following table describes our compensation arrangements with our non-employee directors for 2018.

|

| | | |

Cash |

Board chair fee(1) | $ | 40,000 |

|

Board member fee | 30,000 |

|

Committee chair fee(1) | |

Audit committee | 10,000 |

|

Compensation committee | 5,000 |

|

Nominating and corporate governance committee | 4,000 |

|

Committee member fee |

Audit committee | 5,000 |

|

Compensation committee | 2,500 |

|

Nominating and corporate governance committee | 2,000 |

|

| |

Equity |

Board member RSU award(2) | $ | 100,000 |

|

(1) The board chair and each committee chair receives only the fee due to him or her as chair and does not receive an additional fee as a member of our board or a committee.

(2) On June 6, 2018, which was the date of our 2018 annual meeting, we granted RSUs to each non-employee director. We computed the number of RSUs granted by dividing $100,000 by the average closing price of our common stock for the 10 trading days prior to the date of the annual meeting. Subject to certain exceptions, the RSUs will vest on the earlier of (i) the date of our 2019 annual meeting and (ii) June 6, 2019, in each case, so long as the non-employee director continues to provide services to us through such date.

The following table provides information regarding the compensation earned by our non-employee directors in 2018.

|

| | | | | | | | | | |

Name | | Fees earned or paid in cash ($) | | Stock awards(2)(3) ($) |

| | Option awards(3) ($) |

| | Total ($) |

Robert Bass | | 42,000 | | 103,733 |

| | — |

| | 145,733 |

Julie Bornstein | | 34,000 | | 103,733 |

| | — |

| | 137,733 |

Austin Ligon | | 35,000 | | 103,733 |

| | — |

| | 138,733 |

David Lissy | | 25,000 | | 135,673(4) |

| | — |

| | 160,673 |

Robert Mylod, Jr. | | 45,000 | | 103,733 |

| | — |

| | 148,733 |

James Slavet | | 35,000(1) | | 103,733 |

| | — |

| | 138,733 |

Selina Tobaccowala | | 32,500 | | 103,733 |

| | — |

| | 136,233 |

(1) We paid the fees earned by Mr. Slavet directly to Greylock Partners.

(2) As required by the SEC's rules, the amounts in this column represent the aggregate grant date fair value of RSU awards computed in accordance with the applicable accounting standard. These amounts do not correspond to the actual economic value that may be received by our directors from the RSU awards. Please see Note 11 to our consolidated financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2018 for the assumptions we made in computing the grant date fair value.

(3) The table below reports the number of RSUs and stock options held by each non-employee director as of December 31, 2018.

|

| | | | | | | |

| Name | | Outstanding RSUs | | Outstanding stock options | |

| Robert Bass | | 4,516 | | 66,666 |

| |

| Julie Bornstein | | 4,516 | | 43,400 |

| |

| Austin Ligon | | 4,516 | | 37,567 |

| |

| David Lissy | | 4,516 | | — |

| |

| Robert Mylod, Jr. | | 4,516 | | 133,333 |

| |

| James Slavet | | 4,516 | | — |

| |

| Selina Tobaccowala | | 4,516 | | 75,000 |

| |

(4) In addition to the RSU award granted to Mr. Lissy immediately following our 2018 annual meeting, we also granted Mr. Lissy an RSU award with a grant date fair value of $31,940 in connection with his appointment to our board in February 2018.

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

This section provides information about the 2018 compensation of the named executive officers, or NEOs, listed below. These individuals are also our current executive officers.

|

| | | | |

| Name | | Position* | |

| Glenn Kelman(1) | | President and Chief Executive Officer | |

| Chris Nielsen(2) | | Chief Financial Officer | |

| Bridget Frey(3) | | Chief Technology Officer | |

| Scott Nagel(4) | | President of Real Estate Operations | |

| Adam Wiener(5) | | Chief Growth Officer | |

* Each executive officer holds office until his or her successor is duly elected and qualified or until the officer’s earlier resignation, disqualification, or removal.

(1) Mr. Kelman, age 48, has served as our President and Chief Executive Officer since September 2005.

(2) Mr. Nielsen, age 52, has served as our Chief Financial Officer since June 2013.

(3) Ms. Frey, age 41, has served as our Chief Technology Officer since February 2015. Previously, Ms. Frey served as our Senior Vice President - Engineering from September 2014 to February 2015 and Vice President - Seattle Engineering from April 2012 to September 2014.

(4) Mr. Nagel, age 53, has served as our President of Real Estate Operations since April 2013.

(5) Mr. Wiener, age 40, has served as our Chief Growth Officer since May 2015. Previously, Mr. Wiener served as our Senior Vice President - Marketing, Analytics & New Business from December 2013 to May 2015.

Our Business

We help people buy and sell homes. Our primary business is a residential real estate brokerage. We pair our own agents with our own technology to create a service that is faster, better, and costs less. We use the same combination of technology and local service to originate mortgage loans and offer title and settlement services; we also buy homes directly from homeowners who want an immediate sale, taking responsibility for selling the home while the original owner moves on. Our two primary operating segments are real estate services, for our brokerage business, and properties, for our instant offers business called RedfinNow.

Our Process for Setting NEO Compensation

The compensation committee of our board of directors is primarily responsible for setting the compensation of our NEOs. Its responsibilities include determining the dollar amount for each element of our NEOs' direct compensation, approving the structure, metrics, and targets we use for our performance-based compensation elements, and approving the group of companies we use to evaluate market rates of compensation. When discharging its responsibilities, the committee relies on input from our management and our independent compensation consultant, whose roles are discussed below. Robert Mylod, Jr., the Chairman of our board of directors, also provides recommendations and advice to the committee on our NEOs' compensation.

Our management provides our compensation committee with its perspectives on certain aspects of our NEOs' compensation, including the metrics and targets used in our performance-based compensation elements and the companies that constitute our compensation peers. Additionally, for each NEO except for himself, Mr. Kelman provides his review of the NEO's individual performance to the committee and recommends an amount of compensation for the NEO, informed by that NEO's individual

performance and data regarding market levels of compensation for that NEO's role and scope of responsibility. Mr. Kelman does not participate in the committee's deliberations on his own compensation.

For 2018, our compensation committee engaged Compensia, a national executive compensation consultant. In connection with engaging Compensia, the committee considered the independence factors established by Nasdaq and the SEC and concluded that the engagement did not create any conflicts of interest and that Compensia was independent. Compensia supported the committee by providing input on the compensation of certain of our officers, including our NEOs, and our non-employee directors. Specifically, our compensation committee directed Compensia to:

| |

• | update the peer group used to determine the competitive market for executive compensation; |

| |

• | assess the competitiveness of our executive compensation program; |

| |

• | assess long-term incentive practices for executives; and |

| |

• | assess the competitiveness of our director compensation program. |

Our Compensation Philosophy

Our compensation philosophy is to provide a competitive total pay package that allows us to attract and retain the most qualified individuals to lead our business, while rewarding them largely based on our short-term and long-term financial performance, and for increasing value for our stockholders.

Based on this philosophy, our compensation committee aimed to pay our NEOs in 2018 mostly via equity rather than cash, thereby focusing our NEOs on increasing our company's value long-term. Additionally, the committee established at-risk, performance-based cash and equity compensation as a significant component of our NEOs' 2018 compensation, so that they will realize meaningful portions of their compensation only if our company performs at a high level.

Our Considerations in Setting NEO Compensation

Our compensation committee relied primarily on its subjective consideration of various factors to set the amounts of our NEOs' 2018 compensation. First and foremost, the committee evaluated the NEO's performance and scope of responsibility, and how comparable companies pay a person with similar responsibilities, as described in more detail below. The committee also considered that, since our initial public offering in July 2017, our NEOs have had the broader responsibilities of running a public company. While the committee believed that our NEOs' compensation should reflect these broader responsibilities, it determined that the transition to the higher market compensation rates for public company executives should take several years and not immediately in 2018. Finally, the committee considered our lack of profitability and our culture of thrift, which informs our belief that our NEOs' compensation is largely based on, and should reflect, the efforts of all employees within our company. With respect to Mr. Kelman's compensation, the committee also considered Mr. Kelman's request for 2018 to not receive an increase in his base salary, to be paid a bonus only when we achieve profitability, and to not receive any equity compensation.

In setting Mr. Kelman and Mr. Nielsen's compensation for 2018, our compensation committee reviewed compensation data for the chief executive officer and top finance executive, respectively, of a group of public companies that were in the real estate services, e-commerce, or technology-enabled services industries. These companies, which are listed below, had (i) an enterprise value that ranged between $405 million and $8.4 billion and (ii) trailing-12-month revenue that ranged between $198 million and $1.1 billion.

|

| | | | | |

| Benefitfocus, Inc. | Carvana Co. | Marcus & Millichap, Inc. | RealPage, Inc. | |

| Blucora, Inc. | Conerstone OnDemand, Inc. | NIC Inc. | RE/MAX Holdings, Inc. | |

| Blue Apron Holdings, Inc. | Envestnet, Inc. | Nutrisystem, Inc. | WageWorks, Inc. | |

| CarGurus, Inc. | Evolent Health, Inc. | On Deck Capital, Inc. | Zillow Group, Inc. | |

In setting compensation for our other NEOs, our compensation committee reviewed compensation data from a group of public companies drawn from the Radford Global Technology Survey that were comparable in size and industry to us and that had a median market capitalization of $1.5 billion and median annual revenue of $475 million. Compensia did not provide our compensation committee the identities of this group of companies. Compensia compared Ms. Frey's position to the chief technology officer, Mr. Nagel's position to the top sales executive, and Mr. Wiener's position to the top marketing executive, for the companies in this group.

For each NEO, we refer to the applicable compensation data described above as the peer group data and the companies within the applicable peer group data as our compensation peers. In setting each NEO's compensation, our compensation committee did not determine amounts based solely on comparison against certain compensation percentiles within the peer group data. Rather, the committee used these percentiles to obtain a general understanding of our compensation peers' practices and then relied on its judgment, including consideration of the factors described above in totality, to set an NEO's compensation.

Elements of Our NEOs' Direct Compensation

The table below describes the principal elements of our executive compensation program in 2018. Prior to our initial public offering in July 2017, we granted stock options as part of our executive compensation program but ceased doing so since becoming a public company.

|

| | | | | | |

| Element | | Description | | Objective | |

| Base salary | | Bi-weekly cash payment | | • Provide a guaranteed level of income | |

| Executive bonus plan | | Annual cash payment based on our achievement of financial and operating metrics | | • Provide opportunity to earn additional cash compensation by achieving certain annual company goals | |

| Restricted stock unit, or RSU, awards | | Grant of RSUs that vest into shares of our common stock over four years | | • Align NEOs' and stockholders' interests by rewarding creation of long-term stockholder value• Retention through use of a multi-year vesting schedule | |

| Performance stock unit, or PSU, awards | | Grant of PSUs that are earned and settle in shares of our common stock at the end of a three-year period based on our achievement of financial objectives from 2018 to 2020. | | • Incentivize long-term company achievements• Align NEOs' and stockholders' interests by rewarding creation of long-term stockholder value | |

We use the following terms when describing our NEOs' compensation.

| |

• | Target total direct compensation. This amount is the sum of an NEO's target cash compensation and target equity compensation. |

| |

• | Target cash compensation. This amount is the sum of an NEO's base salary and his or her target payment under our executive bonus plan. |

| |

• | Target equity compensation. This amount is the sum of the dollar value of an NEO's RSU award and the target dollar value of his or her PSU award. |

Target cash compensation

The cash component of an NEO's target total direct compensation consists of base salary and potential payments under our executive bonus plan, where an NEO has an opportunity to earn threshold, target, and maximum amounts based on our actual performance as measured against one or more financial or operating goals. Under the plan, our compensation committee can establish any financial or operating goal that applies to our company as a whole or any of our departments.

The table below sets forth our NEOs' target cash compensation for 2018.

|

| | | | | | | | | | | | | | |

| NEO | | Base salary | | Target payment under 2018 executive bonus plan | | Target cash compensation | |

| Glenn Kelman(1) | | $ | 250,000 |

| | $ | 150,000 |

| | $ | 400,000 |

| |

| Chris Nielsen | | $ | 350,000 |

| | $ | 100,000 |

| | $ | 450,000 |

| |

| Bridget Frey | | $ | 300,000 |

| | $ | 150,000 |

| | $ | 450,000 |

| |

| Scott Nagel | | $ | 300,000 |

| | $ | 200,000 |

| | $ | 500,000 |

| |

| Adam Wiener | | $ | 300,000 |

| | $ | 100,000 |

| | $ | 400,000 |

| |

(1) While Mr. Kelman formally participated in the executive bonus plan for 2018, he requested that his payment be subject to an additional requirement that we achieve positive net income for 2018 even though we did not expect to achieve, and had not budgeted for, positive net income in 2018. Accordingly, Mr. Kelman did not expect to receive a payment under the executive bonus plan for 2018.

In setting our NEOs' target cash compensation, our compensation committee considered the factors described under "Our Considerations in Setting NEO Compensation" above, including looking at the 25th percentile of the peer group data to gain an understanding of target cash compensation for our compensation peers' executives. Based on these considerations, our compensation committee increased the base salary for our NEOs (other than Mr. Kelman) and increased the target payment under our executive bonus plan for our NEOs (other than Messrs. Kelman and Nielsen), as set forth the tables below. While Mr. Kelman's target cash compensation was significantly below that of our compensation peers' chief executive officer and at his request, the committee believed that he was appropriately incentivized based on his existing equity ownership in our company.

|

| | | | | | | | | | |

| NEO | | 2017 base salary | | 2018 base salary(1) | |

| Glenn Kelman | | $ | 250,000 |

| | $ | 250,000 |

| |

| Chris Nielsen | | $ | 300,000 |

| | $ | 350,000 |

| |

| Bridget Frey | | $ | 250,000 |

| | $ | 300,000 |

| |

| Scott Nagel | | $ | 250,000 |

| | $ | 300,000 |

| |

| Adam Wiener | | $ | 250,000 |

| | $ | 300,000 |

| |

(1) The base salary increases for our NEOs were effective in May 2018. Accordingly, our NEOs received their 2017 base salary for the pay periods in 2018 prior to the effective date of the increase.

|

| | | | | | | | | | |

| NEO | | Target payment under 2017 executive bonus plan | | Target payment under 2018 executive bonus plan | |

| Glenn Kelman | | $ | 150,000 |

| | $ | 150,000 |

| |

| Chris Nielsen | | $ | 100,000 |

| | $ | 100,000 |

| |

| Bridget Frey | | $ | 100,000 |

| | $ | 150,000 |

| |

| Scott Nagel | | $ | 175,000 |

| | $ | 200,000 |

| |

| Adam Wiener | | $ | 75,000 |

| | $ | 100,000 |

| |

The table and discussion below describe the 2018 goals established under our executive bonus plan and the threshold, target, and maximum achievement and payment levels for each goal. The payment level is expressed as a percentage, ranging from 0% to 150%, of the NEO's target payment under our 2018 executive bonus plan, as shown in the table above. Achievement of goals between each of the levels was measured on a straight-line interpolation basis, and the corresponding payment is likewise determined on a corresponding straight-line interpolation basis.

|

| | | | | | | | | | | | | | | | | | | | | | |

| | | Threshold | | Target | | Maximum | |

| Goal | | Achievement | | Payout | | Achievement | | Payout | | Achievement | | Payout | |

| Total mobile & web visits, monthly average | | * | | 0% | | * | | 25 | % | | * | | 37.5 | % | |

| Revenue, excluding properties segment | | $ | 445,000,000 |

| | 0% | | $ | 475,983,107 |

| | 35 | % | | $ | 505,000,000 |

| | 52.5 | % | |

| Net loss, excluding properties segment | | $ | 16,195,133 |

| | 0% | | $ | 11,195,133 |

| | 20 | % | | $ | 6,195,133 |

| | 30 | % | |

| Full year total Net Promoter Score, or NPS | | 78 | % | | 0% | | 81 | % | | 10 | % | | 84 | % | | 15 | % | |

| Cost per brokerage transaction | | * | | 0% | | * | | 10 | % | | * | | 15 | % | |

| | | | | 0% | | | | 100 | % | | | | 150 | % | |

* We are not disclosing the achievement levels for these goals because they are confidential commercial and financial information for which disclosure would cause us competitive harm. For the monthly average visits goal, our annual growth of visits would have been the highest for the past five years if we reached the maximum achievement level. At the target achievement level, our annual growth would have been the same as our slowest growth rate within the past five years, but we believe that this level was still challenging to attain because it becomes increasingly difficult to sustain or increase an annual growth rate as the number of visits significantly increases each year. For the cost per brokerage transaction goal, attainment at either the target or maximum achievement level would have resulted in the best achievement of this metric within the past five years. We believe that the achievement levels for this goal, including at threshold, were particularly challenging because we made the strategic decision to reduce the number of customers we assigned to each of our buy-side agents during 2018 (thereby potentially reducing the number of transactions), while we expected our total cost of brokerage services to stay the same or increase.

Total mobile & web visits, monthly average. We measure this goal by the total number of visits during 2018 to Redfin.com and our mobile applications, divided by 12. We use this goal because visits to our website and mobile applications are the primary ways we meet customers and are an indicator of our business activity.

Revenue, excluding properties segment. This goal is our revenue for 2018, as reported in our audited financial statements, less revenue from our properties segment. We use this goal because revenue growth is an important indicator of how much our business is growing annually. We exclude revenue from our properties segment because this segment has been a part of our operations for a shorter period of time, relative to our other businesses, and the disproportionately greater revenue from one RedfinNow transaction compared to our other business transactions.

Net loss, excluding properties segment. This goal is our net loss for 2018, as reported in our audited financial statements, excluding gross profit or loss from our properties segment. We use this goal because it measures our cost discipline and our ability to scale our business. We exclude gross profit or loss from our properties segment because we exclude properties segment revenue in the goal described above.

Full year total NPS. This goal measures the NPS of every Redfin customer or a customer of one of our partner agents who responds to a customer survey, other than a home tour survey, during 2018. Survey responses range from 0 to 10, with 10 being the best customer experience. We compute the NPS percentage by dividing (i) the number of customers who respond with a 9 or a 10, less the number who respond with a number between 0 and 6, by (ii) the total number of respondents. We use this goal because it measures customer satisfaction, which is a key emphasis for our business.

Cost per brokerage transaction. We measure this goal by dividing (i) cost of services for brokerage transactions within our real estate services segment by (ii) the number of brokerage transactions, for 2018. We use this goal because it measures our ability to scale our real estate services segment, which is a key driver for us to achieve profitability.

For 2018, our executive bonus plan also included an additional requirement that the revenue goal described above exceed the threshold achievement of $445,000,000 for any payment to be made under the plan. Because our revenue, excluding properties segment, was $441,927,447, our NEOs did not receive a payment under the executive bonus plan for 2018.

Target equity compensation

The equity component of an NEO's target total direct compensation consists of (i) time-based RSU awards that vest into shares of our common stock dependent on the NEO's continued service with us and (ii) PSU awards that are earned and settle into shares of our common stock dependent on both our achievement of one or more pre-established performance objectives and the NEO's continued service with us.

The table below sets forth our NEOs' target equity compensation for 2018.

|

| | | | | | | | | | | | | | |

| NEO | | RSU award(1) | | PSUs award(1) | | Target equity compensation | |

| Chris Nielsen | | $ | 650,000 |

| | $ | 650,000 |

| | $ | 1,300,000 |

| |

| Bridget Frey | | $ | 550,000 |

| | $ | 550,000 |

| | $ | 1,100,000 |

| |

| Scott Nagel | | $ | 550,000 |

| | $ | 550,000 |

| | $ | 1,100,000 |

| |

| Adam Wiener | | $ | 550,000 |

| | $ | 550,000 |

| | $ | 1,100,000 |

| |

(1) Our compensation committee granted RSUs and PSUs in an amount based on the dollar value in the table. To determine the number of shares underlying these awards, we converted the dollar value of the award into a number based on the average closing price of our common stock for the 20 trading days prior to the date of our compensation committee's approval of the grant.

In setting our NEOs' target equity compensation, our compensation committee considered the factors described under "Our Considerations in Setting NEO Compensation" above, including looking at

the 50th percentile of the peer group data to gain an understanding of target equity compensation for our compensation peers' executives, as well as Mr. Kelman's request to not receive any equity compensation in 2018. The committee also sought to grant RSUs and PSUs in equal proportions to achieve balance among the three considerations of driving specific company performance goals, alignment with our stockholders' interests, and retention. Similar to its view in establishing Mr. Kelman's target cash compensation, the committee believed that Mr. Kelman's interests were appropriately aligned with our stockholders' interests and he was appropriately incentivized based on his existing equity ownership in our company.

RSU award. One quarter of each NEO's 2018 RSU award will vest on May 20, 2019 and one sixteenth of the award will vest quarterly thereafter, such that the entire award will be vested by May 20, 2022, subject to the NEO's continued service on each applicable vesting date.

PSU award. The dollar value of each NEO's PSU award, and the corresponding number of PSUs, described in the table above reflect the target number of PSUs granted. The actual number of PSUs that may be earned and settle into shares of our common stock will depend on our achievement of the PSU awards' performance conditions. No PSUs will be earned unless our aggregate income (loss) from operations for the three years from 2018 to 2020 is better than the threshold amount established by our compensation committee. If we achieve this threshold, then the number of PSUs that may be earned will range between 25% and 200% of the target number of PSUs granted and will depend on our aggregate gross profit for the three years from 2018 to 2020, as described in the table below. If our aggregate gross profit is less than the minimum level, then no PSUs will be earned. Achievement of aggregate gross profit between each of the levels will be measured on a straight-line interpolation basis, and the corresponding number of PSUs will likewise be determined on a corresponding straight-line interpolation basis. Any PSUs that are earned at the end of the three-year performance period will vest and settle into shares of our common stock upon the committee's certification of the achievement level.

|

| | | | |

| Aggregate gross profit achievement level | | PSUs earned as a percentage of target number | |

| Minimum | | 25% | |

| Target | | 100% | |

| Maximum | | 200% | |

Our compensation committee conditioned payment of the PSUs on aggregate income (loss) from operations and gross profit because both metrics measure our drive towards profitability. By using both metrics, the committee intended to incentivize our NEOs to pursue improvement in both areas without focus on one over the other. Both metrics are calculated in accordance with U.S. Generally Accepted Accounting Principles.

Other Benefits Available to Our NEOs

In addition to the elements of direct compensation described above, our NEOs are also eligible to receive other standard employee benefits. Consistent with our culture of thrift, we do not offer our NEOs any benefit that is unavailable on the same basis to our other full-time employees. The most significant of these benefits include (i) health and life insurance coverage, (ii) paid-time off, (iii) the opportunity to purchase shares of our common stock at a discount pursuant to our 2017 Employee Stock Purchase Plan, (iv) the ability to contribute to a 401(k) retirement plan (we do not match contributions by any of our employees), and (v) the opportunity to purchase transit and parking using pre-tax dollars.

Agreements with Our NEOs

We do not have an employment agreement with any of our NEOs. In June 2017, we entered into amended and restated employment offer letters with each NEO. Pursuant to these offer letters, each NEO

is an "at-will" employee, receives a base salary, has the opportunity to earn an incentive bonus under our executive bonus plan, and is eligible to receive our standard employee benefits.

We have entered into a change in control and severance agreement with each of our NEOs that provides for payments and benefits to the NEO upon a qualifying termination of employment in connection with a change in control. Please see "Potential Payments upon Termination or Change in Control-Change in Control Severance Agreement" below for more information.

Share Ownership and Anti-Hedging Policies

We have adopted a share ownership policy that requires each NEO to beneficially own a minimum dollar value of our common stock. We also prohibit each NEO from purchasing any instrument designed to offset a decrease in the value of our common stock owned by the NEO. For more information about these policies, please see "Our Corporate Governance-Certain Governance Policies" below.

Certain Tax and Accounting Impacts of Our NEO Compensation

The Tax Cuts and Jobs Acts of 2017 amended a tax law that governed whether we can deduct certain types of compensation paid to an NEO that exceeds $1,000,000 for any year. For this purpose, compensation is based on tax laws and is not necessarily the same as the amount reported for an NEO in the Summary Compensation Table below. Because of uncertainties in the interpretation and implementation of the amendment, there is no guaranty on whether we will be able to fully deduct our NEOs' compensation.

We record compensation expense for the equity awards granted to our NEOs based on the grant date fair value of the awards, and we recognize the expense over the service period for the award. We determine both the grant date fair value and the service period based on accounting standards. To the extent an NEO forfeits his or her award or we determine that the probable outcome of the PSU award's performance condition is no longer the same as it was on the grant date, then we will adjust, in the period of the forfeiture or determination, the previously recognized expense.

Compensation Committee Report

The compensation committee has reviewed and discussed with management the section entitled "Compensation Discussion and Analysis" above. Based on this review and discussion, the compensation committee recommended to Redfin's board of directors that the "Compensation Discussion and Analysis" section be included in this proxy statement.

James Slavet

Selina Tobaccowala

Summary Compensation Table

The following table provides information regarding our NEOs' compensation for 2018 and, to the extent required by the SEC's rules, 2017 and 2016.

|

| | | | | | | | | | | | | | | | | |

Name and

principal position | | Year | | Salary

($) | | Stock awards(1) ($) | | Option awards(1)

($) | | Non-equity incentive plan compensation(2)

($) | | Total

($) |

Glenn Kelman

(President and Chief Executive Officer) | | 2018 | | 250,000 |

| | — |

| | — |

| | — |

| | 250,000 |

|

| | 2017 | | 250,000 |

| | — |

| | 6,337 |

| | — |

| | 256,337 |

|

| | 2016 | | 250,871 |

| | — |

| | 68,258 |

| | — |

| | 319,129 |

|

Chris Nielsen

(Chief Financial Officer) | | 2018 | | 329,808 |

| | 1,264,554 |

| | — |

| | — |

| | 1,594,362 |

|

| | 2017 | | 286,923 |

| | — |

| | 814,997 |

| | 99,165 |

| | 1,201,085 |

|

Bridget Frey (Chief Technology Officer) | | 2018 | | 279,808 |

| | 1,070,018 |

| | — |

| | — |

| | 1,349,826 |

|

| | 2017 | | 250,000 |

| | — |

| | 81,497 |

| | 99,165 |

| | 430,662 |

|

| | 2016 | | 250,681 |

| | — |

| | 396,000 |

| | 121,000 |

| | 767,681 |

|

Scott Nagel

(President of Real Estate Operations) | | 2018 | | 279,808 |

| | 1,070,018 |

| | — |

| | — |

| | 1,349,826 |

|

| | 2017 | | 250,000 |

| | — |

| | 325,997 |

| | 173,538 |

| | 749,535 |

|

| | 2016 | | 250,724 |

| | — |

| | 396,000 |

| | 211,750 |

| | 858,474 |

|

Adam Wiener (Chief Growth Officer) | | 2018 | | 279,808 |

| | 1,070,018 |

| | — |

| | — |

| | 1,349,826 |

|

(1) As required by the SEC's rules, the amounts in this column represent, for 2018, the aggregate grant date fair value of RSU and PSU awards, and, for 2017 and 2016, the aggregate grant date fair value of the stock option awards, in each case computed in accordance with the applicable accounting standard. These amounts do not correspond to the actual economic value that may be received by our NEOs from the equity awards. Please see Note 11 to our consolidated financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2018 for the assumptions we made in computing the grant date fair value. We computed the grant date fair value of PSU awards based on our achievement of the PSU awards' performance conditions at 100% of target, which was the probable outcome of the performance conditions on the grant date. Assuming maximum achievement of the PSU awards' performance conditions, the grant date fair value of the PSU awards would have been $1,264,554 for Mr. Nielsen and $1,070,017 for each of Ms. Frey, Mr. Nagel, and Mr. Wiener and the aggregate grant date fair value of all equity awards during 2018 would have been $1,896,831 for Mr. Nielsen and $1,605,026 for each of Ms. Frey, Mr. Nagel, and Mr. Wiener.

(2) The amounts in this column represent the amounts earned under our executive bonus plan for the respective year.

Grants of Plan-Based Awards Table

The following table provides information regarding grants of awards to our NEOs during 2018 pursuant to our executive bonus plan and, with respect to RSU and PSU awards, our 2017 Equity Incentive Plan.

|

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Name | | Grant date | | Estimated possible payout under non-equity incentive plan awards(1) | | Estimated future payouts under equity incentive plan awards(2) | | All other stock awards: Number of shares of stock or units(3) (#) | | Grant date fair value of stock and option awards(4) ($) |

Threshold ($) | | Target ($) | | Maximum ($) | | Threshold (#) | | Target (#) | | Maximum (#) |

Glenn Kelman | | | | — |

| | 150,000(5) |

| | 225,000(5) |

| | | | | | | | | | |

Chris Nielsen | | | | — |

| | 100,000 |

| | 150,000 |

| | | | | | | | | | |

| | 6/1/2018 | | | | | | | | 7,311 |

| | 29,245 |

| | 58,490 |

| | | | 632,277 |

|

| | 6/1/2018 | | | | | | | | | | | | | | 29,245 |

| | 632,277 |

|

Bridget Frey | | | | — |

| | 150,000 |

| | 225,000 |

| | | | | | | | | | |

| | 6/1/2018 | | | | | | | | 6,186 |

| | 24,746 |

| | 49,492 |

| | | | 535,009 |

|

| | 6/1/2018 | | | | | | | | | | | | | | 24,746 |

| | 535,009 |

|

Scott Nagel | | | | — |

| | 200,000 |

| | 300,000 |

| | | | | | | | | | |

| | 6/1/2018 | | | | | | | | 6,186 |

| | 24,746 |

| | 49,492 |

| | | | 535,009 |

|

| | 6/1/2018 | | | | | | | | | | | | | | 24,746 |

| | 535,009 |

|

Adam Wiener | | | | — |

| | 100,000 |

| | 150,000 |

| | | | | | | | | | |

| | 6/1/2018 | | | | | | | | 6,186 |

| | 24,746 |

| | 49,492 |

| | | | 535,009 |

|

| | 6/1/2018 | | | | | | | | | | | | | | 24,746 |

| | 535,009 |

|

(1) The amounts in this column represent the amounts that could have been paid under our 2018 executive bonus plan. We did not make any payments to our NEOs under our 2018 executive bonus plan.

(2) The amounts in this column represent the potential shares that could be earned pursuant to PSU awards granted in 2018.

(3) The amounts in this column represent the RSU awards granted in 2018.

(4) As required by the SEC's rules, the amounts in this column represent the aggregate grant date fair value of PSU and RSU awards granted during 2018, computed in accordance with the applicable accounting standard. We computed the grant date fair value of PSU awards based on our achievement of the PSU awards' performance conditions at 100% of target, which was the probable outcome of the performance conditions on the grant date. These amounts do not correspond to the actual economic value that may be received by our NEOs from the equity awards.

(5) While Mr. Kelman formally participated in the executive bonus plan for 2018, he requested that his payment be subject to an additional requirement that we achieve positive net income for 2018 even though we did not expect to achieve, and had not budgeted for, positive net income in 2018. Accordingly, Mr. Kelman did not expect to receive a payment under the executive bonus plan for 2018.

Outstanding Equity Awards at Year-End Table

The following table provides information regarding our NEOs' outstanding option, RSU, and PSU awards as of December 31, 2018.

|

| | | | | | | | | | | | | | | | | | |

| | | | Option Awards | | Stock Awards |

Name | | Vesting commencement date | | Number of securities underlying unexercised options exercisable

(#) | | Number of securities underlying unexercised options unexercisable(1)

(#) | | Option exercise price

($) | | Option expiration date | | Number of shares or units of stock that have not vested(2) (#) | | Market value of shares or units of stock that have not vested(3) ($) | | Equity incentive plan awards: number of unearned shares, units or other rights that have not vested(4) (#) | | Equity incentive plan awards: market or payout value of unearned shares, units or other rights that have not vested(3) ($) |

Glenn Kelman | | 8/16/2011 | | 180,313 | | — | | 0.36 | | 8/16/2021 | | | | | | | | |

| | 7/26/2013 | | 211,111 | | — | | 3.75 | | 11/26/2023 | | | | | | | | |

| | 11/23/2015 | | 372,569 | | 110,764 | | 8.61 | | 11/24/2025 | | | | | | | | |

| | 2/03/2016 | | 10,047 | | — | | 8.97 | | 2/03/2026 | | | | | | | | |

| | 9/27/2016 | | 8,148 | | — | | 8.10 | | 9/29/2026 | | | | | | | | |

| | 6/14/2017 | | 1,296 | | — | | 10.80 | | 6/14/2027 | | | | | | | | |

Chris Nielsen | | 6/17/2013 | | 681,599 | | — | | 2.25 | | 8/2/2023 | | | | | | | | |

| | 5/2/2016 | | 53,807 | | 29,526 | | 9.15 | | 5/11/2026 | | | | | | | | |

| | 5/1/2017 | | 65,970 | | 100,696 | | 10.80 | | 6/14/2027 | | | | | | | | |

| | 5/20/2018 | | | | | | | | | | 29,245 | | 421,128 | | | | |

| | N/A | | | | | | | | | | | | | | 7,311 | | 105,278 |

Bridget Frey | | 6/20/2011 | | 47,917 | | — | | 0.36 | | 08/16/2021 | | | | | | | | |

| | 3/1/2012 | | 81,666 | | — | | 1.41 | | 04/12/2022 | | | | | | | | |

| | 4/1/2013 | | 103,203 | | — | | 1.77 | | 06/18/2023 | | | | | | | | |

| | 11/25/2013 | | 98,462 | | — | | 3.75 | | 11/26/2023 | | | | | | | | |

| | 5/4/2014 | | 62,489 | | — | | 6.42 | | 07/10/2024 | | | | | | | | |

| | 8/24/2014 | | 34,842 | | — | | 6.39 | | 10/14/2024 | | | | | | | | |

| | 1/1/2015 | | 228,471 | | 4,862 | | 7.38 | | 04/13/2025 | | | | | | | | |

| | 5/1/2015 | | 45,791 | | 5,325 | | 8.61 | | 10/28/2025 | | | | | | | | |

| | 5/2/2016 | | 64,582 | | 35,417 | | 9.15 | | 05/11/2026 | | | | | | | | |

| | 5/1/2017 | | 6,592 | | 10,074 | | 10.80 | | 06/14/2027 | | | | | | | | |

| | 5/20/2018 | | | | | | | | | | 24,746 | | 356,342 | | | | |

| | N/A | | | | | | | | | | | | | | 6,186 | | 89,078 |

Scott Nagel | | 12/8/2009 | | 141,667 | | — | | 0.36 | | 12/08/2019 | | | | | | | | |

| | 5/1/2011 | | 66,666 | | — | | 0.36 | | 8/16/2021 | | | | | | | | |

| | 4/1/2012 | | 151,666 | | — | | 1.41 | | 4/12/2022 | | | | | | | | |

| | 5/1/2013 | | 216,666 | | — | | 1.77 | | 6/18/2023 | | | | | | | | |

| | 5/4/2014 | | 69,432 | | — | | 6.42 | | 7/10/2024 | | | | | | | | |

| | 5/1/2015 | | 112,770 | | 13,113 | | 8.61 | | 10/28/2025 | | | | | | | | |

| | 5/2/2016 | | 64,576 | | 35,423 | | 9.15 | | 5/11/2026 | | | | | | | | |

| | 5/1/2017 | | 26,386 | | 40,280 | | 10.80 | | 6/14/2027 | | | | | | | | |

| | 5/20/2018 | | | | | | | | | | 24,746 | | 356,342 | | | | |

|

| | | | | | | | | | | | | | | | | | |

| | | | Option Awards | | Stock Awards |

Name | | Vesting commencement date | | Number of securities underlying unexercised options exercisable

(#) | | Number of securities underlying unexercised options unexercisable(1)

(#) | | Option exercise price

($) | | Option expiration date | | Number of shares or units of stock that have not vested(2) (#) | | Market value of shares or units of stock that have not vested(3) ($) | | Equity incentive plan awards: number of unearned shares, units or other rights that have not vested(4) (#) | | Equity incentive plan awards: market or payout value of unearned shares, units or other rights that have not vested(3) ($) |

| | N/A | | | | | | | | | | | | | | 6,186 | | 89,078 |

Adam Wiener | | 4/1/2013 | | 198,334 | | — | | 1.77 | | 6/18/2023 | | | | | | | | |

| | 11/25/2013 | | 166,666 | | — | | 3.75 | | 11/26/2023 | | | | | | | | |

| | 5/1/2015 | | 223,989 | | 26,046 | | 8.61 | | 10/28/2025 | | | | | | | | |

| | 5/2/2016 | | 21,521 | | 11,812 | | 8.10 | | 9/28/2026 | | | | | | | | |

| | 5/2/2016 | | 43,050 | | 23,616 | | 9.15 | | 5/11/2026 | | | | | | | | |

| | 5/1/2017 | | 32,981 | | 50,352 | | 10.80 | | 6/14/2027 | | | | | | | | |

| | 5/20/2018 | | | | | | | | | | 24,746 | | 356,342 | | | | |

| | N/A | | | | | | | | | | | | | | 6,186 | | 89,078 |

(1) Subject to the NEO's continuing service, one quarter of each option award becomes exercisable on the one year anniversary of the vesting commencement date and the remaining amounts become exercisable equally each month thereafter, such that the entire option will be exercisable on the four year anniversary of the vesting commencement date.

(2) Subject to the NEO's continuing service, one quarter of the RSU award vests on the one year anniversary of the vesting commencement date and the remaining amounts vest equally each quarter thereafter, such that the entire award will be vested on the four year anniversary of the vesting commencement date.

(3) The market value is based on the closing price of our common stock on December 31, 2018.

(4) Subject to the NEO's continuing service and our achievement of the PSU award's performance conditions at the threshold level, the PSU award becomes earned upon our compensation committee's certification of our achievement of the performance metrics following the end of the three-year performance period.

Option Exercises and Stock Vested Table

The following table provides information regarding exercises of stock options by our NEOs during 2018. None of our NEOs had any RSUs vest during 2018.

|

| | | | | | | | |

| | | Option awards | |

| Name | | Number of shares acquired on exercise (#) | | Value realized on exercise(1) ($) | |

| Glenn Kelman | | — |

| | — |

| |

| Chris Nielsen | | 58,000 |

| | 970,460 |

| |

| Bridget Frey | | 40,000 |

| | 740,457 |

| |

| Scott Nagel | | 25,000 |

| | 514,000 |

| |

| Adam Weiner | | — |

| | — |

| |

(1) As required by the SEC's rules, the value realized on exercise is based on the difference between the closing price of our common stock on the day of exercise and the exercise price of the option award. These amounts do not correspond to the actual economic value that was received by our NEOs from their exercise of the option awards.

Potential Payments upon Termination or Change in Control

Change in Control Severance Agreement

Each NEO has a change in control severance agreement, or change in control agreement, with us. The change in control agreement provides that the NEO will receive the payments and benefits described below upon either (i) a termination by us of the NEO’s employment without “cause” or (ii) a voluntary resignation by the NEO from his or her employment with “good reason,” in each case during the period three months before a “change in control” and ending 12 months after a “change in control” of our company. The change in control agreement defines the terms “cause,” “good reason” and “change in control.” We refer to either of these terminations of employment as a “qualifying termination.” The payments and benefits provided by the change in control agreement are contingent upon the consummation of the change in control of our company and the NEO executing a release of claims in favor of our company. Each NEO's change in control agreement expires in July 2020.

In the event of qualifying termination, the NEO will be entitled to: (i) a lump sum payment equal to six months of base salary, (ii) a lump sum payment equal to six months of costs to continue health insurance coverage under COBRA, and (iii) have then-outstanding and unvested stock option and RSU awards accelerate and become vested as if the NEO had continued in service for an additional 12 months. An NEO's PSU awards that are deemed earned upon a change in control, as described below, are eligible for acceleration and vesting to the same extent as stock options and RSU awards.