| | | | | |

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

|

| Schedule 14A Information |

|

| Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 |

| (Amendment No. ) |

|

þ Filed by the Registrant | ¨ Filed by a Party other than the Registrant |

| | | | | |

Check the appropriate box: |

þ | Preliminary Proxy Statement |

¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

¨ | Definitive Proxy Statement |

¨ | Definitive Additional Materials |

| ¨ | Soliciting Material under § 240.14a-12 |

Redfin Corporation |

| (Name of Registrant as Specified In Its Charter) |

|

N/A |

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

| | | | | | | | |

Payment of Filing Fee (Check the appropriate box): |

þ | No fee required |

¨ | Fee paid previously with preliminary materials. |

¨ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

April 28, 2022

Dear Redfin Stockholder,

We invite you to attend Redfin Corporation's 2022 Annual Meeting of Stockholders to be held on June 14, 2022 at 10:00 a.m. Pacific Time. We will hold the meeting as a virtual meeting conducted online via a live webcast. You will be able to attend the meeting, submit your questions and comments during the meeting, and vote your shares at the meeting by visiting www.virtualshareholdermeeting.com/RDFN2022.

You are receiving this proxy statement and the accompanying proxy materials because you were a Redfin stockholder as of April 18, 2022, which is the record date for the annual meeting, and are eligible to vote at the meeting. For the ten days prior to the meeting and subject to verification of your voting eligibility, you may examine, for a purpose germane to the meeting, a list of stockholders of record entitled to vote by emailing a request to legal@redfin.com. During the meeting, you will be able to access this list through the website for the meeting. Please use this opportunity to participate in Redfin’s affairs by voting on the matters described in this proxy statement.

Whether or not you plan to attend the annual meeting, your vote is very important, and we encourage you to cast your ballot as soon as possible in one of the ways outlined in this proxy statement.

Sincerely,

David Lissy

Chairman of the Board

Table of Contents

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING

1.Why did I receive this proxy statement and other materials related to the annual meeting?

Each person who owned any shares of our common stock as of the close of business on April 18, 2022, or the record date, is entitled to vote at the annual meeting. You are receiving this proxy statement and accompanying proxy materials because you can vote at the meeting and our board of directors is soliciting your proxy to vote. The materials describe the matters to be voted on at the meeting and provide you with other important information so that you can make informed decisions. Please review the materials before casting your vote.

We delivered this proxy statement and other meeting materials to our stockholders eligible to vote on or around April 28, 2022.

2.When is the annual meeting?

We will start the meeting at 10:00 a.m. Pacific Time on June 14, 2022.

3.How do I attend the annual meeting?

The meeting will be a virtual meeting conducted online via a live webcast, and you can attend by visiting www.virtualshareholdermeeting.com/RDFN2022 from anywhere with access to the Internet and a web browser. Shortly before the meeting's start time, please visit the meeting's website and log in using your control number. Please see question 19 for where to find your control number and question 11 for whom to contact if you encounter technical difficulties accessing the meeting.

4.What are the matters to be voted on at the annual meeting?

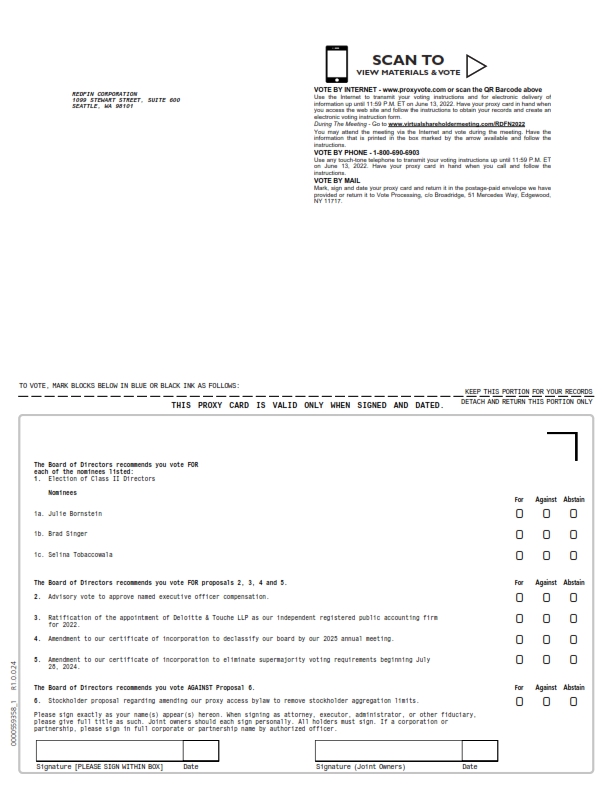

You are being asked to vote on the following:

1.The election of Julie Bornstein, Brad Singer, and Selina Tobaccowala to our board of directors as Class II directors.

2.The approval of our named executive officers' compensation, on an advisory basis.

3.The ratification of our audit committee's appointment of Deloitte & Touche LLP as our independent registered public accounting firm for 2022.

4.Amendment to our certificate of incorporation to declassify our board by our 2025 annual meeting.

5.Amendment to our certificate of incorporation to eliminate supermajority voting requirements beginning July 28, 2024.

6.Stockholder proposal regarding amending our proxy access bylaw to remove stockholder aggregation limits, if properly presented at the meeting.

While we do not expect any other matter to be voted on at the meeting, the proxy holders will have discretionary authority to vote shares represented by a returned proxy on any additional matter that is presented for a vote at the meeting.

5.What are my choices in voting on each matter? How does the board of directors recommend that I vote?

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Proposal number | | Item | | Voting choices | | Board recommendation | |

| 1 | | Election of directors | | For(1) Against Abstain | | For(1) | |

| 2 | | Approval of our named executive officers' compensation | | For Against Abstain | | For | |

| 3 | | Ratification of appointment of auditor | | For Against Abstain | | For | |

| 4 | | Amendment to our certificate of incorporation to declassify our board by our 2025 annual meeting | | For Against Abstain | | For | |

| 5 | | Amendment to our certificate of incorporation to eliminate supermajority voting requirements beginning July 28, 2024 | | For Against Abstain | | For | |

| 6 | | Stockholder proposal regarding amending our proxy access bylaw to remove stockholder aggregation limits | | For Against Abstain | | Against | |

(1) The voting choices and board recommendation are with respect to each Class II director nominee.

6.What vote is required to approve each matter? How do abstentions and broker non-votes affect approval?

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Proposal number | | Item | | Votes required for approval | | Abstentions | | Broker non-vote(1) | |

| 1 | | Election of directors | | Majority of votes cast(2) | | No effect | | No effect | |

| 2 | | Approval of our named executive officers' compensation | | Majority of votes cast | | No effect | | No effect | |

| 3 | | Ratification of appointment of auditor | | Majority of votes cast | | No effect | | Not applicable | |

| 4 | | Amendment to our certificate of incorporation to declassify our board by our 2025 annual meeting | | Majority of outstanding shares | | Same as against vote | | Same as against vote | |

| 5 | | Amendment to our certificate of incorporation to eliminate supermajority voting requirements beginning July 28, 2024 | | Majority of outstanding shares | | Same as against vote | | Same as against vote | |

| 6 | | Stockholder proposal regarding amending our proxy access bylaw to remove stockholder aggregation limits | | Majority of votes cast | | No effect | | No effect | |

(1) A broker non-vote occurs when a beneficial holder does not provide specific voting instructions to its broker or nominee and the broker or nominee does not have discretionary authority to vote the shares. Brokers and nominees do not have discretionary authority to vote uninstructed shares with respect to proposals 1, 2, 4, 5, and 6 but do have discretionary authority to vote uninstructed shares with respect to proposal 3. Please see question 20 to determine if you are a beneficial holder.

(2) Pursuant to our corporate governance guidelines, any incumbent director seeking reelection in an uncontested election must submit an irrevocable offer of resignation that becomes effective upon (i) such director failing to receive a majority of votes cast and (ii) our board's acceptance of such resignation.

7.How many votes does each share represent?

Each share of our common stock represents one vote. As of the record date, we had shares outstanding.

8.How do I vote?

You may vote before the meeting through any of the following methods:

•By Internet: visit www.proxyvote.com

•By telephone: call 1-800-690-6903 (if you are a record holder) or 1-800-454-8683 (if you are a beneficial holder)

•By mail: complete, date, and sign your proxy card (if you are a record holder) or voting instruction form (if you are a beneficial holder) and return it in the postage-paid envelope

Internet and telephone voting are available 24 hours a day and will close at 11:59 p.m. Eastern Time on June 13, 2022. If you are voting by mail, please return your proxy card or voting instruction form in a timely manner to ensure it is received by us or your broker or nominee, respectively, before the meeting. Please see question 20 to determine if you are a record holder or a beneficial holder.

You may also vote at the meeting through the website www.virtualshareholdermeeting.com/RDFN2022. Even if you intend to attend and vote at the meeting, we strongly encourage you to vote before the meeting using one of the methods described above.

To vote through any of the methods described above, you will need your control number. Please see question 19 for where to find your control number.

9.How can I revoke my proxy or change my vote?

If you are a record holder, you can revoke your proxy by delivering a notice to our principal executive offices stating that you are revoking your proxy. This revocation is valid only if we receive your notice before the meeting. Please see question 21 for the address of our principal executive offices.

If you are a record holder, you may change your vote before the meeting by submitting a later-dated proxy through any of the methods described under question 8. You do not need to deliver the later-dated proxy using the same method as the original proxy.

If you are a beneficial holder, please contact your broker or nominee for the procedures on revoking your proxy or changing your vote before the meeting.

Both record holders and beneficial holders may change their vote by attending the meeting and voting at the meeting. Your attendance at the meeting, alone, will not revoke your proxy.

Please see question 20 to determine if you are a record holder or a beneficial holder.

10.Can I ask questions or make comments during the annual meeting?

If you were a stockholder as of the record date, you will be able to submit questions and comments through the meeting's website. To ask a question or make a comment, you will need to log in using your control number. Please see question 19 for where to find your control number. Time permitting, we will read every appropriate question or comment and, if necessary, respond to it. Examples of inappropriate questions or comments include those about personal concerns not shared by our stockholders generally or those that use offensive language. We will address questions and comments in the order in which they were received but with priority for stockholders who have not previously submitted a question or comment during the meeting. A replay of the meeting, including the questions and answers portion, will be available on the meeting's website through June 13, 2023.

11.Who can I contact if I experience technical difficulties accessing the annual meeting or during the meeting?

You can call the technical support number that will be posted on the login page of the meeting's website, and someone will be available to help resolve your technical difficulties.

12.Who will bear the cost of the solicitation of proxies by our board of directors?

Redfin will bear the cost of the solicitation.

13.What is the deadline for submitting a stockholder proposal to be presented at the 2023 annual meeting of stockholders?

If you wish to submit a stockholder proposal for inclusion in our proxy materials for the 2023 annual meeting, then we must receive your proposal at our principal executive offices no later than December 29, 2022. Please review the SEC’s Rule 14a-8 for the requirements you must meet and the information you must provide if you wish to submit this type of stockholder proposal.

For other types of stockholder proposals to be presented at the 2023 annual meeting, you must deliver notice of your intent to submit a proposal to our principal executive offices no earlier than 5:00 p.m. Eastern Time on March 1, 2023 and no later than 5:00 p.m. Eastern Time on March 31, 2023. Please review our bylaws for the requirements you must meet and the information you must provide if you wish to submit a proposal under this process.

Please see question 21 for the address of our principal executive offices.

14.What is the deadline for nominating a director candidate at the 2023 annual meeting of stockholders?

If you wish to use our bylaws' proxy access provision and include a director candidate in Redfin's proxy material for our 2023 annual meeting, then we must receive your written notice at our principal executive offices no earlier than 5:00 p.m. Eastern Time on December 29, 2022 and no later than 5:00 p.m. Eastern Time on January 28, 2023.

Otherwise, you must deliver notice of your intent to nominate a director candidate to our principal executive offices no earlier than 5:00 p.m. Eastern Time on March 1, 2023 and no later than 5:00 p.m. Eastern Time on March 31, 2023.

In each instance, please review our bylaws for the requirements you must meet and the information you must provide if you wish to nominate a person.

Please see question 21 for the address of our principal executive offices.

15.What is the deadline for providing notice of soliciting proxies in support of director nominees other than our board's nominees with respect to the 2023 annual meeting of stockholders?

You must provide notice to our principal executive offices no later than April 15, 2023. Please review the SEC’s Rule 14a-19 for the requirements you must meet and the information you must provide if you wish to solicit proxies in support of director nominees other than our board's nominees. In addition, please see question 14 for the deadline for nominating a person for election as a director at the 2023 annual meeting of stockholders.

Please see question 21 for the address of our principal executive offices.

16.I share an address with one or more other stockholders. Why did we receive only one set of annual meeting materials?

We have utilized an SEC rule that permits us to deliver one set of annual meeting materials to multiple stockholders sharing an address. However, if any stockholder at the shared address would like to

receive a separate copy of the materials, then we will deliver promptly the additional copies upon written or oral request.

If you are a record holder, you can make a request by delivering a notice to Broadridge Financial Solutions at 51 Mercedes Way, Edgewood, New York 11717, Attention: Householding Department or by calling 1-866-540-7095.

If you are a beneficial holder, please contact your broker or nominee for instructions on how to receive separate copies of the materials.

Please see question 20 to determine if you are a record holder or a beneficial holder.

17.I share an address with one or more other stockholders and we each received separate copies of the annual meeting materials. Can we receive only one set of materials for future meetings?

Yes. If you are a record holder, please make a request by contacting Broadridge Financial Solutions at the address or phone number provided in question 16. If you are a beneficial holder, please contact your broker or nominee for instructions on how to receive one set of materials for future meetings.

Please see question 20 to determine if you are a record holder or a beneficial holder.

18.How can I receive proxy materials for future annual meetings electronically?

To sign-up for email notification and electronic delivery of proxy materials for our future annual meetings, please visit enroll.icsdelivery.com/RDFN.

19.Where can I find my control number?

Your control number is the sixteen-digit number found next to the label "Control Number" in the body of your email, if you received email notification, or your proxy card, voting instruction form, or notice of Internet availability of proxy materials, if you received paper notification.

20.Am I a record holder or a beneficial holder? What is the difference?

If the shares that you own are registered in your name with American Stock Transfer & Trust Company, our transfer agent, then you are a record holder of our shares and can vote your shares directly. If the shares that you own are registered in the name of a broker or other nominee, then you are a beneficial holder of our shares and must instruct your broker or nominee on how to vote your shares. Please see question 8 for how to vote your shares or provide voting instructions to your broker or nominee. If you are a beneficial holder and your broker or nominee does not receive instructions from you, then it may lack discretion to vote your shares, as described in question 6.

21.What is the address for Redfin’s principal executive offices?

The address for our principal executive offices is 1099 Stewart Street, Suite 600, Seattle, WA 98101, Attention: Legal Department. We also encourage you to email any correspondence to us at legal@redfin.com.

PROPOSAL 1 - ELECTION OF DIRECTORS

Our board of directors currently consists of ten directors and is divided into three classes, designated as Class I, Class II, and Class III. Directors in Class II are standing for election at the annual meeting. Robert Mylod, Jr. has notified us that he will not stand for reelection at the meeting and will leave our board effective immediately after the annual meeting. At the meeting, stockholders will vote on a proposal to declassify our board by our 2025 annual meeting. See proposal 4 for more information. If proposal 4 is approved, directors in Class B and Class A will stand for election at the 2023 and 2024 annual meeting, respectively, and our board of directors will be declassified by our 2025 annual meeting. If proposal 4 is not approved, directors in Class III and Class I will stand for election at the 2023 annual meeting and 2024 annual meeting, respectively.

Our board of directors, upon the recommendation of our nominating and corporate governance committee, has nominated Julie Bornstein, Brad Singer, and Selina Tobaccowala for election as Class II directors. For more information about each Class II director nominee, including why we believe each nominee is qualified to serve as a director, see "Class II Director Nominees" below. If a Class II director nominee is unable to serve, or for good cause will not serve, as a director, then the proxy holders will vote a returned proxy for the election of a substitute nominee who is proposed by our board of directors. If elected at the meeting, the Class II directors will serve until the 2025 annual meeting and until such director's successor is elected and qualified, or, if earlier, such director's resignation or removal.

We evaluated the independence of our directors based on the listing standards of Nasdaq, which is where our common stock is listed, and concluded that each director, other than Glenn Kelman, is independent.

Class II Director Nominees

Julie Bornstein, age 52, has been one of our directors since October 2016. Since February 2018, Ms. Bornstein has been chief executive officer at The Yes (an e-commerce marketplace), which she also co-founded. Previously, Ms. Bornstein was chief operating officer at Stitch Fix (an online personal styling services company) from March 2015 to September 2017. Before that, Ms. Bornstein was chief marketing officer & chief digital officer at Sephora. Ms. Bornstein is currently on the board of directors of two other public companies - sweetgreen and WW International. Ms. Bornstein has a bachelor's degree from Harvard University and an MBA from Harvard Business School. We believe that Ms. Bornstein's senior leadership experience at various online services companies qualifies her to serve on our board of directors.

Brad Singer, age 55, has been one of our directors since March 2022. Mr. Singer was chief operating officer at ValueAct Capital (a venture capital firm) from May 2012 to December 2021 and served as a partner from May 2012 to June 2021. Previously, Mr. Singer was senior executive vice president and chief financial officer at Discovery Communications and chief financial officer & treasurer at American Tower. Mr. Singer is currently on the board of directors of one other public company - sweetgreen - and previously served on the board of directors of another public company - Rolls-Royce. Mr. Singer has a bachelor's degree from the University of Virginia and an MBA from Harvard Business School. We believe that Mr. Singer’s experience as a venture capital investor and a senior finance executive, including as the chief financial officer of a large publicly traded company, qualifies him to serve on our board of directors. One of our other directors recommended Mr. Singer to our nominating and corporate governance committee.

Selina Tobaccowala, age 45, has been one of our directors since January 2014. Since August 2019, Ms. Tobaccowala has been chief digital officer at Openfit (a fitness company). Previously, Ms. Tobaccowala was chief executive officer at Gixo (a fitness company), which she also co-founded, from April 2016 to August 2019. Before that, Ms. Tobaccowala was president and chief technology officer at

SurveyMonkey, senior vice president of product & technology at Tickemaster Europe, and vice president of engineering at Evite.com, which she also co-founded. Ms. Tobaccowala is currently on the board of directors of one other public company - Lazard Growth Acquisition Corp. I. Ms. Tobaccowala has a bachelor's degree from Stanford University. We believe that Ms. Tobaccowala’s technology background and senior leadership experience at multiple online services companies qualifies her to serve on our board of directors.

Class III Continuing Directors

Robert Bass, age 72, has been one of our directors since October 2016. Mr. Bass was a partner at Deloitte & Touche from 1982 to 2012, and served as vice chairman from 2006 to 2012. Mr. Bass is currently on the board of directors of two other public companies - Groupon and Bowlero - and previously served on the board of directors of another public company - Sims Metal Management. Mr. Bass is also currently on the board of trustees of the Blackstone Private Credit Fund and the Blackstone Secured Lending Fund, as well as the board of directors of Apex Tool Group. Mr. Bass has a bachelor's degree from Emory University and an MBA from the Columbia University Graduate School of Business. We believe that Mr. Bass’s knowledge of public company financial reporting and accounting and his accounting firm leadership experience qualifies him to serve on our board of directors.

Glenn Kelman, age 51, has been one of our directors since March 2006. Since September 2005, Mr. Kelman has been our chief executive officer. Previously, Mr. Kelman was vice president of marketing and product management at Plumtree Software, which he also co-founded. Mr. Kelman has a bachelor's degree from the University of California at Berkeley. We believe that Mr. Kelman’s deep understanding of our company and his real estate industry experience qualifies him to serve on our board of directors.

Kerry D. Chandler, age 58, has been one of our directors since August 2020. Since January 2022, Ms. Chandler has served as chief human resources officer of Bombas (an apparel company). Previously, Ms. Chandler was chief human resources officer of Endeavor (a global sports and entertainment company) from December 2018 to January 2022 and was chief human resources officer of Under Armour (a sports apparel and footwear company) from January 2015 to November 2018. Before that, Ms. Chandler was global head of human resources at Christie's, executive vice president of human resources at the National Basketball Association, and senior vice president of human resources at ESPN (a part of The Walt Disney Company) and Hong Kong Disneyland, as well as various human resources roles of increasing responsibility at IBM, Motorola, Exxon, and McDonnell Douglas. Ms. Chandler is also on the board of directors of Lyra Health. Ms. Chandler has a bachelor's degree from Lincoln University, a master's degree from Washington University in St. Louis, and a master's degree from McGill University. We believe that Ms. Chandler's human resources experience across high-growth companies qualifies her to serve on our board of directors.

Class I Continuing Directors

Austin Ligon, age 71, has been one of our directors since September 2010. Since 2006, Mr. Ligon has been a venture investor. Previously, Mr. Ligon served as president and chief executive officer at CarMax, which he also co-founded. Mr. Ligon has bachelor's and master's degrees from the University of Texas at Austin and an MBA from the Yale School of Management. We believe that Mr. Ligon’s experience scaling and managing CarMax from startup to nationwide operations, with extensive online presence and nationally distributed field operations, qualifies him to serve on our board of directors.

David Lissy, age 56, has been one of our directors since February 2018 and has served as chairman of our board since July 2020. Since January 2020, Mr. Lissy has been chairman of Bright Horizons Family Solutions (a publicly traded child care company), where he was also executive chairman from January 2018 to December 2019 and chief executive officer from 2002 to January 2018. Mr. Lissy is also a director of Jumpstart, Scripta Insights, and BeneLynk and chair of the board of trustees of Ithaca College, where he received his bachelor's degree. We believe that Mr. Lissy’s experience leading a

publicly traded company, as both a director and an executive officer, qualifies him to serve on our board of directors.

James Slavet, age 52, has been one of our directors since November 2009. Since April 2006, Mr. Slavet has been a partner of Greylock Partners (a venture capital firm). Previously, Mr. Slavet was vice president / general manager in search & marketplace at Yahoo! and chief operating officer at Guru, which he also founded. Mr. Slavet has a bachelor's degree from Brown University and an MBA from Harvard Business School. We believe that Mr. Slavet’s experience advising and managing growth-oriented technology companies, including as an operating executive, qualifies him to serve on our board of directors.

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF EACH CLASS II DIRECTOR NOMINEE.

INFORMATION REGARDING OUR BOARD OF DIRECTORS AND ITS COMMITTEES

Board Diversity

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Board Diversity Matrix (As of April 28, 2022)* |

| Total Number of Directors | | 9 |

| Part I: Gender Identity | | Female | | Male | | Non-Binary | | Did Not Disclose Gender |

| Directors | | 3 | | 6 | | | | |

| Part II: Demographic Background |

| African American or Black | | 1 | | | | | | |

| Alaskan Native or Native American | | | | | | | | |

| Asian | | 1 | | | | | | |

| Hispanic or Latinx | | | | | | | | |

| Native Hawaiian or Pacific Islander | | | | | | | | |

| White | | 1 | | 6 | | | | |

| Two or More Races or Ethnicities | | | | | | | | |

| LGBTQ+ | | |

| Did Not Disclose Demographic Background | | |

* The board diversity matrix excludes Mr. Mylod because he will not stand for reelection at the annual meeting and will leave our board of directors effective immediately after the annual meeting.

Board Meetings and Annual Meeting Attendance

During 2021, our board of directors held six meetings and acted by unanimous written consent two times. Each director attended at least 75% of the meetings of our board and each committee on which the director served.

Our policy is to invite and encourage each director to be present at our annual meeting. Each person serving as a director at the time of our 2021 annual meeting attended the meeting.

Communicating with our Board of Directors

For instructions on how to communicate with our board of directors or specific individual directors, please see our Corporate Governance Guidelines available under the "Governance" section of our investor relations website located at investors.redfin.com.

Committees of our Board of Directors

Our board of directors has established an audit committee, a compensation committee, and a nominating and corporate governance committee. Please see below for information regarding each committee.

Each committee operates under a written charter that outlines the committee’s duties and responsibilities. Each committee periodically reviews and updates, as necessary, its charter to reflect the committee's evolving role. You can obtain the charter for each committee in the “Governance” section of our investor relations website at investors.redfin.com.

| | | | | |

| Audit Committee |

| Members | •Robert Bass (Chair)* •Austin Ligon •Robert Mylod, Jr.** |

| |

| 2021 activity | •Held seven meetings •Acted by unanimous written consent one time |

| |

| Responsibilities | •Review and discuss with management our quarterly and annual financial results and the related earnings releases and earnings guidance distributed to the public •Discuss with management and our independent auditors the selection, application, and disclosure of critical accounting policies and practices •Review and discuss with our independent auditors and management their periodic reviews of the adequacy and effectiveness of our accounting and financial reporting processes and systems of internal control, including any significant deficiencies and material weaknesses in their design or operation •Direct responsibility for the appointment, compensation, retention, oversight and, if appropriate, replacement of our independent auditors |

* Our board of directors has determined that Mr. Bass qualifies as an “audit committee financial expert,” as the SEC has defined that term.

** Mr. Mylod will not stand for reelection at the annual meeting and will leave our board of directors effective immediately after the annual meeting. We expect to name Brad Singer to our audit committee following the meeting, assuming that he is elected by our stockholders at the meeting.

| | | | | |

| Compensation Committee |

| Members | •James Slavet (Chair) •Kerry D. Chandler •Selina Tobaccowala |

| |

| 2021 activity | •Held three meetings •Acted by unanimous written consent five times |

| |

| Responsibilities | •Review our overall compensation strategy, including base salary, incentive compensation, and equity-based compensation, to assure that it promotes stockholder interests, supports our objectives, and provides for appropriate rewards and incentives for our management and employees •Annually review and approve all cash-based and equity-based incentive compensation plans and arrangements •Annually review all director compensation and benefits for service on our board and committees and recommend to our board the form and amount of director compensation |

| | | | | |

| Nominating and Corporate Governance Committee |

| Members | •Julie Bornstein (Chair) •Robert Bass |

| |

| 2021 activity | •Held five meetings |

| |

| Responsibilities | •Develop and recommend policies regarding our director nomination process •Identify, evaluate, and select, or recommend that our board selects, nominees for election or appointment to our board •Periodically review and assess the adequacy of our Corporate Governance Guidelines, Code of Conduct and Ethics, and any other compliance policies that the committee deems appropriate |

Director Nomination Process

Our nominating and corporate governance committee is responsible for identifying and evaluating director nominees. When evaluating a candidate, the committee considers his or her qualifications, expertise, diversity, and experience in totality, without targeting specific qualities or skills or requiring minimum qualifications. With respect to diversity, the committee does not maintain a formal, written policy on considering diversity in identifying nominees, but it may consider differences of viewpoint, professional experience, education, skillset, and other unique qualities and attributes that contribute to heterogeneity across our board of directors, including characteristics such as race, gender, and national origin.

Our nominating and corporate governance committee will consider director candidates recommended by our stockholders. The committee will evaluate a stockholder-recommended candidate in the same manner as other candidates, as described above. Stockholders who wish to recommend a candidate for the committee to consider should send us information regarding the candidate by email to legal@redfin.com or by hardcopy to 1099 Stewart Street, Suite 600, Seattle, WA 98101, Attention: Corporate Secretary.

Risk Oversight

Our board of directors, as a whole, has responsibility for risk oversight, and each committee of our board of directors oversees and reviews risk in areas that are relevant to it. The risk oversight responsibility of our board of directors and its committees is supported by our management reporting processes, which are designed to provide visibility to our board and to our personnel who are responsible for risk assessment, information about the identification, assessment, and management of critical risks.

Along with our management, our audit committee is responsible for reviewing our major financial and cybersecurity risk exposures while our compensation committee is responsible for reviewing our major compensation-related risk exposures. For each risk area, the applicable committee and our management are also responsible for reviewing the steps we have taken to monitor or mitigate any identified exposures. We believe that our current compensation practices do not create risks that are reasonably likely have a material adverse effect on us.

Audit Committee Report

Redfin’s management has primary responsibility for preparing the company’s consolidated financial statements and for its financial reporting process. The audit committee has reviewed, and discussed with management, Redfin’s audited consolidated financial statements for the year ended December 31, 2021. The audit committee provides the company’s board of directors with the information and materials the committee deems necessary to make the board aware of financial matters requiring the attention of the board. The audit committee also meets in executive sessions, without the presence of the company’s management, with Deloitte & Touche LLP, the company’s independent registered public

accounting firm. The audit committee has discussed with Deloitte & Touche LLP the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board and the Securities and Exchange Commission.

The audit committee has received the written disclosures and the letter from Deloitte & Touche LLP required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent accountant’s communications with the audit committee concerning independence, and has discussed with Deloitte & Touche LLP its independence.

Based on the review and discussions referred to above, the audit committee recommended to the board of directors that the audited consolidated financial statements for the year ended December 31, 2021 be included in Redfin’s annual report on Form 10-K for the year ended December 31, 2021 for filing with the Securities and Exchange Commission.

Robert Bass

Austin Ligon

Robert Mylod, Jr.

Director Compensation

Our board of directors establishes our directors' compensation based on the recommendation of our compensation committee. The committee annually reviews the amount and form of our directors' compensation, including evaluating data regarding market levels of compensation provided by Compensia, a national executive compensation consultant, and recommends any adjustments based on that review.

We compensate our non-employee directors with a combination of cash and equity, in the form of restricted stock unit, or RSU, awards. Glenn Kelman, our chief executive officer, also serves as a director. We compensate Mr. Kelman solely for serving as our chief executive officer – see “Executive Compensation” below – and do not provide additional compensation for his service as a director.

In April 2021, following our compensation committee's annual review of director compensation and upon the committee's recommendation, cash compensation fees for our non-employee directors remained unchanged from 2020, and the annual RSU award increased to $170,000 for our board chair and $145,000 for our other non-employee directors. The annual RSU award was previously $115,000 for all of our non-employee directors, including our board chair.

The table below describes our cash compensation arrangements with our non-employee directors.

| | | | | | | | |

| Fee type | | 2021 |

Board chair fee(1) | | $ | 65,000 | |

| Board member fee | | 35,000 | |

Committee chair fee(1) | | |

| Audit committee | | 30,000 | |

| Compensation committee | | 10,000 | |

| Nominating and corporate governance committee | | 10,000 | |

| Committee member fee | | |

| Audit committee | | 15,000 | |

| Compensation committee | | 5,000 | |

| Nominating and corporate governance committee | | 5,000 | |

(1) The board chair and each committee chair receives only the fee due to him or her as chair and does not receive an additional fee as a member of our board or a committee.

Immediately following our 2021 annual meeting in June, we granted each of our then non-employee directors, excluding David Lissy, our board chair, a $145,000 RSU award. We granted Mr. Lissy a $170,000 RSU award. We computed the number of RSUs granted by dividing the dollar value of the RSU award by the average closing price of our common stock for the 30 trading days prior to the date of our 2021 annual meeting. These awards vest on June 12, 2022, so long as the non-employee director continues to provide services to us through such date. Our non-employee directors can defer settlement of their annual RSU award to the sixtieth day following the day that they are no longer providing services to us or, if earlier, following a change in control transaction.

The following table provides information regarding the compensation earned by our non-employee directors in 2021.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name | | Fees earned or paid in cash ($) | | Stock awards(1)(2)(3) ($) | | Option awards(3) ($) | | Total ($) |

| Robert Bass | | 70,000 | | 155,887 | | — | | | 225,887 |

| Julie Bornstein | | 45,000 | | 155,887 | | — | | | 200,887 |

| Kerry D. Chandler | | 40,000 | | 155,887 | | — | | | 195,887 |

| Austin Ligon | | 50,000 | | 155,887 | | — | | | 205,887 |

| David Lissy | | 65,000 | | 182,775 | | — | | | 247,775 |

| Robert Mylod, Jr. | | 50,000 | | 155,887 | | — | | | 205,887 |

| James Slavet | | 45,000 | | 155,887 | | — | | | 200,887 |

| Selina Tobaccowala | | 40,000 | | 155,887 | | — | | | 195,887 |

(1) As required by the SEC's rules, the amounts in this column represent the grant date fair value of the non-employee director's 2021 RSU award computed in accordance with the applicable accounting standard. These amounts do not correspond to the actual economic value that may be received by our directors from the RSU awards. Please see Note 12 to our consolidated financial statements included in our annual report on Form 10-K for the year ended December 31, 2021 for the assumptions we made in computing the grant date fair value.

(2) Messrs. Lissy and Mylod, have deferred settlement of their 2021 RSU award to the sixtieth day following the day that they are no longer providing services to us or, if earlier, following a change in control transaction.

(3) The table below reports the number of RSU and stock option awards held by each non-employee director as of December 31, 2021. RSU awards that have vested, but whose settlement into shares have been deferred, are reported separately.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name | | RSU awards | | Vested RSUs awards with deferred settlement | | Stock option awards | |

| Robert Bass | | 2,493 | | — | | 66,666 | |

| Julie Bornstein | | 2,493 | | — | | 20,000 | |

| Kerry D. Chandler | | 2,493 | | — | | — | |

| Austin Ligon | | 2,493 | | 9,243 | | 37,567 | |

| David Lissy | | 2,923 | | 5,476 | | — | |

| Robert Mylod, Jr. | | 2,493 | | 9,243 | | 116,250 | |

| James Slavet | | 2,493 | | 3,767 | | — | |

| Selina Tobaccowala | | 2,493 | | — | | — | |

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

This section provides information about the 2021 compensation of the named executive officers, or NEOs, listed below.

| | | | | | | | | | | | | | |

| Name | | Position | |

| Glenn Kelman | | Chief executive officer | |

| Chris Nielsen | | Chief financial officer | |

| Ee Lyn Khoo* | | Chief human resources officer | |

| Adam Wiener | | President of real estate operations | |

| Bridget Frey | | Chief technology officer | |

* Ms. Khoo's employment with us ended on January 14, 2022. However, she is considered one of our NEOs for 2021 pursuant to the SEC's rules.

Our Business

We help people buy and sell homes. Representing customers in over 100 markets in the United States and Canada, we are a residential real estate brokerage. We pair our own agents with our own technology to create a service that is faster, better, and costs less. We meet customers through our listings-search website and mobile application. We use the same combination of technology and local service to originate mortgage loans and offer title and settlement services; we also buy homes directly from homeowners who want an immediate sale, taking responsibility for selling the home while the original owner moves on. We also offer digital platforms to connect consumers with available apartments and houses for rent. Our mission is to redefine real estate in the consumer’s favor.

Our Process for Setting NEO Compensation

The compensation committee of our board of directors is primarily responsible for setting the compensation of our NEOs. Its responsibilities include determining (i) the dollar amount for each element of our NEOs' direct compensation, (ii) the structure, metrics, and targets we use for our performance-based compensation elements, and (iii) the group of companies we use to evaluate market rates of compensation. When discharging its responsibilities, the committee relies on input from our management and our independent compensation consultant, whose roles are discussed below. David Lissy, our chairman, also assists the committee in determining Mr. Kelman's compensation. After its review and evaluation of input from our management and compensation consultant, the committee recommends to our board of directors the compensation to be paid to our NEOs, and our board approves the compensation following deliberation.

Our management provides our compensation committee with its perspectives on certain aspects of our NEOs' compensation, including the metrics and targets used in our performance-based compensation elements and the companies that constitute our compensation peers. Additionally, for each NEO except for himself, Mr. Kelman provides his review of the NEO's individual performance to the committee and recommends an amount of compensation for the NEO, informed by that NEO's individual performance and data regarding market levels of compensation for that NEO's role and scope of responsibility. Mr. Kelman does not participate in deliberations by our board of directors or the committee on his own compensation.

For 2021, our compensation committee engaged Compensia, a national executive compensation consultant. In connection with engaging Compensia, the committee considered the independence factors established by Nasdaq and the SEC and concluded that the engagement did not create any conflicts of

interest and that Compensia was independent. Compensia supported the committee by providing input on the compensation of certain of our officers, including our NEOs, and our non-employee directors. Specifically, our compensation committee directed Compensia to:

•update the peer group used to determine the competitive market for executive and director compensation;

•assess the competitiveness of our executive compensation program;

•assess long-term incentive practices for executives; and

•assess the competitiveness of our director compensation program.

Our Compensation Philosophy

Our compensation philosophy is to provide a competitive total pay package that allows us to attract and retain the most qualified individuals to lead our business, while rewarding them largely based on our short-term and long-term financial performance, and for increasing value for our stockholders.

Based on this philosophy, our compensation committee aimed to pay our NEOs in 2021 mostly via equity rather than cash, thereby focusing our NEOs on increasing our company's value over the long-term. Additionally, the committee used at-risk, performance-based equity compensation as a significant component of our NEOs' 2021 compensation, so that they will realize meaningful portions of their compensation only if our company performs at a high level.

Our Considerations in Setting NEO Compensation

Our compensation committee relied primarily on its subjective consideration of various factors to set the amounts of our NEOs' 2021 compensation. First and foremost, the committee, together with our board chairman, evaluated our chief executive officer's performance and the committee considered our chief executive officer's evaluation of each other NEO's performance. The committee also considered each NEO's scope of responsibility, historical compensation with us, and internal pay equity. Additionally, the committee reviewed how our compensation peers pay executives with similar responsibilities, as described in more detail below. Finally, with respect to our chief executive officer's compensation, the committee considered our lack of profitability and our culture of thrift, which informs our belief that our chief executive officer's compensation is largely based on, and should reflect, the efforts of all employees within our company.

In setting the 2021 compensation for Messrs. Kelman, Nielsen, and Wiener and Ms. Frey, our compensation committee reviewed compensation data from a peer group of public companies. We review our peer group annually based on financial and other criteria that include industry, revenue, enterprise value, gross profit, gross margin, product or service offering, and headquarter location. The 20 companies used to evaluate our 2021 compensation decisions for Messrs. Kelman, Nielsen, and Wiener and Ms. Frey are listed below and we refer to them as our primary peers.

| | | | | | | | | | | | | | | | | | | | |

| 2U | | Chegg | | Marcus & Millichap | | Shutterstock |

| AppFolio | | Cornerstone OnDemand | | Opendoor Technologies | | Stamps.com |

| Avalara | | Envestnet | | Overstock.com | | The RealReal |

| Bright Horizons Family Solutions | | frontdoor | | Q2 | | TripAdvisor |

| CarGurus | | Guidewire Software | | RE/MAX | | Zillow Group |

Because the compensation peers named above did not have sufficient disclosed data in SEC filings for a position similar to that held by Ms. Khoo, our chief human resources officer, Compensia selected a group of public companies from the Radford Global Technology Survey to provide our compensation committee with comparative market data for Ms. Khoo. These companies, which are listed

below, had revenues, enterprise values, and gross profit that were consistent with our primary peers named above. We refer to these companies as the Radford peers.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2U | | Black Knight | | Conerstone OnDemand | | InterDigital | | Teradata |

| 8x8 | | Blackbaud | | Coupa Software | | Jack Henry & Associates | | TTEC |

| ACI Worldwide | | CarGurus | | Envestnet | | Manhattan Associates | | Tyler Technologies |

| Allscripts Healthcare Solutions | | CDK Global | | Five9 | | Nuance Communications | | Yelp |

| AppFolio | | Ceridian HCM | | frontdoor | | Paylocity | | Zillow Group |

| Avalara | | Chegg | | Guidewire Software | | Q2 | | Zuora |

For each NEO, we refer to the applicable compensation data described above as the peer group data and the companies within the applicable peer group data as our compensation peers. In setting each NEO's compensation, our compensation committee did not determine amounts based solely on comparison against certain compensation percentiles within the peer group data. Rather, the committee used these percentiles to obtain a general understanding of our compensation peers' practices and then relied on its judgment, including consideration of the factors described above in totality, to set an NEO's compensation.

Elements of Our NEOs' Direct Compensation

The table below describes the principal elements of our executive compensation program in 2021.

| | | | | | | | | | | | | | | | | | | | |

| Element | | Description | | Objective | | Recipient |

| Base salary | | Bi-weekly cash payment | | •Provide a guaranteed level of income | | Each NEO |

| Executive bonus plan | | Annual cash payment based on our achievement of financial and diversity metrics | | •Provide opportunity to earn additional cash compensation by achievement of certain annual company goals | | Each NEO, other than CEO |

| Restricted stock unit, or RSU, awards | | Grant of RSUs that vest into shares of our common stock over four years | | •Align officer's and stockholders' interests by rewarding creation of long-term stockholder value •Retention through use of a multi-year vesting schedule | | Each NEO, other than CEO |

| Performance stock unit, or PSU, awards | | Grant of PSUs that are earned and settle in shares of our common stock at the end of a three-year period based on our achievement of objectives during that period | | •Incentivize long-term company achievements •Align officer's and stockholders' interests by rewarding creation of long-term stockholder value | | Each NEO, other than CEO |

We use the following terms when describing our NEOs' compensation.

•Target total direct compensation. This amount is the sum of an NEO's target cash compensation and target equity compensation.

•Target cash compensation. This amount is the sum of an NEO's base salary and his or her target payment under our executive bonus plan.

•Target equity compensation. This amount is the sum of the dollar value of an NEO's RSU award and the target dollar value of his or her PSU award.

Target Cash Compensation

The cash component of an NEO's target total direct compensation consisted of base salary and, other than Mr. Kelman, a potential payment under our executive bonus plan, where each NEO has an opportunity to earn threshold, target, and maximum amounts based on our actual performance as measured against one or more financial or operating goals. For each year's executive bonus plan, our compensation committee can establish any financial or operating goal that applies to our company as a whole or any of our departments, and goals may vary from year to year at the committee's discretion.

Because we suspended our 2020 executive bonus plan, there was not a potential payment under the plan for 2020. Nonetheless, to ensure comparability with each NEO's target cash compensation against prior and future years, each NEO's target cash compensation for 2020 continued to consist of base salary and a target payment under the plan. However, each NEO could have earned only the base salary portion of his or her target cash compensation. We resumed our executive bonus plan in 2021, as described below.

The table below sets forth our NEOs' target cash compensation for 2021, compared to 2020.

| | | | | | | | | | | | | | |

| NEO | | 2020 target cash compensation(1) | | 2021 target cash compensation |

| Glenn Kelman | | $ | 300,000 | | | $ | 300,000 | |

| Chris Nielsen | | $ | 700,000 | | | $ | 700,000 | |

Ee Lyn Khoo(2) | | N/A | | $ | 550,000 | |

| Adam Wiener | | $ | 600,000 | | | $ | 600,000 | |

| Bridget Frey | | $ | 550,000 | | | $ | 550,000 | |

(1) Includes both a base salary and a target payment under our 2020 executive bonus plan. However, each NEO could have earned only the base salary portion because we suspended our executive bonus plan for 2020.

(2) Ms. Khoo started employment with us in 2021 and therefore did not receive any 2020 compensation from us. For more information about Ms. Khoo's 2021 compensation, please see "—Ms. Khoo's 2021 Compensation" below.

In setting our NEOs' target cash compensation, our compensation committee considered the factors described under "Our Considerations in Setting NEO Compensation" above, including looking at the peer group data to gain an understanding of target cash compensation for our compensation peers' executives. With respect to Mr. Kelman's target cash compensation, the committee also considered his request for no or a minimal increase to his base salary and to be paid a bonus only when we achieve profitability.

After determining the target cash compensation for each NEO, our compensation committee first set the 2021 base salary for the NEO and then established a target payout for the NEO under our 2021 executive bonus plan. This payout represented the difference between an NEO's target cash compensation and his or her base salary. The committee maintained our NEOs' base salaries and target payments under our 2021 executive bonus plan at the 2020 amounts. These amounts are reflected in the tables below.

| | | | | | | | | | | | | | |

| NEO | | 2020 base salary | | 2021 base salary |

| Glenn Kelman | | $ | 300,000 | | | $ | 300,000 | |

| Chris Nielsen | | $ | 500,000 | | | $ | 500,000 | |

| Ee Lyn Khoo | | N/A | | $ | 350,000 | |

| Adam Wiener | | $ | 400,000 | | | $ | 400,000 | |

| Bridget Frey | | $ | 350,000 | | | $ | 350,000 | |

| | | | | | | | | | | | | | |

| NEO | | Target payment under 2020 executive bonus plan(1) | | Target payment under 2021 executive bonus plan |

Glenn Kelman(2) | | $ | — | | | $ | — | |

| Chris Nielsen | | $ | 200,000 | | | $ | 200,000 | |

| Ee Lyn Khoo | | N/A | | $ | 200,000 | |

| Adam Wiener | | $ | 200,000 | | | $ | 200,000 | |

| Bridget Frey | | $ | 200,000 | | | $ | 200,000 | |

(1) Our 2020 executive bonus plan was suspended and our NEOs could not have received a payment under the plan. Our compensation committee established these target payments to ensure comparability with each NEO's target cash compensation against prior and future years.

(2) At Mr. Kelman's request, he will participate in the annual executive bonus plan only if we budget for positive net income for the year. Additionally, if Mr. Kelman participates in the plan for a given year, then he will receive a payout only if we achieve positive net income for that year. We did not budget for positive net income in either 2020 nor 2021. Accordingly, Mr. Kelman did not participate in the executive bonus plan for those years.

Our 2021 executive bonus plan had a potential payout ranging from 0 to 150% of an NEO's target. The payout depended on our achievement of the financial and diversity goals described below. Financial goals accounted for 75% of the target payout, and diversity goals, which we added to our executive bonus plan in 2021, accounted for 25%.

The financial goals measure our achievement of 2021 revenue across three of our financial reporting segments, as well as our 2021 net loss, adjusted to exclude our RentPath business that we acquired in April 2021. The three revenue goals are for our (i) real estate services segment, (ii) properties segment, and (iii) other segment. Our "real estate services" segment consists of our brokerage and partner businesses, and our "properties" segment consists largely of our RedfinNow business. Our "other" segment consists largely of our title business and other ancillary sources of revenue. For purposes of evaluating achievement of other segment revenue, our compensation committee included revenue from our mortgage segment because our mortgage business was within the other segment when the committee initially established our 2021 executive bonus plan, but our mortgage business became its own reporting segment when we prepared our 2021 audited financial statements. The net loss goal is our 2021 net loss, adjusted to exclude losses attributable to our RentPath subsidiary, as well as transaction expenses associated with the acquisition. The same financial goals applied to each NEO.

The diversity goals measure the percentage of management employees and individual contributor employees who are persons of color or underrepresented minorities, depending on the Redfin business unit being assessed. NEOs' diversity goals were based on one of three business units that related to their general oversight: our real estate businesses (i.e., field), our administrative departments (i.e., headquarters), or both (i.e., company-wide). Mr. Nielsen and Ms. Frey were subject to headquarters diversity goals, Ms. Khoo was subject to company-wide diversity goals, and Mr. Wiener was subject to field diversity goals.

The table below shows the achievement by each NEO of the financial and diversity goals, along with the amount they earned under our 2021 executive bonus plan.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| NEO | | Target Payment under 2021 Executive Bonus Plan | | Achievement of Financial Goals | | Achievement of Diversity Goals | | Total Achievement | | Amount Earned under 2021 Executive Bonus Plan |

| Chris Nielsen | | $ | 200,000 | | | 42.5 | % | | 37.5 | % | | 80.0 | % | | $ | 160,000 | |

Ee Lyn Khoo(1) | | $ | 200,000 | | | 42.5 | % | | 28.1 | % | | 70.6 | % | | $ | 141,200 | |

| Adam Wiener | | $ | 200,000 | | | 42.5 | % | | 18.75 | % | | 61.3 | % | | $ | 122,600 | |

| Bridget Frey | | $ | 200,000 | | | 42.5 | % | | 37.5 | % | | 80.0 | % | | $ | 160,000 | |

(1) While Ms. Khoo earned $141,200 pursuant to our 2021 executive bonus plan, she did not receive any payments under the plan because her employment had ended before we paid the earned amount.

The table below details the threshold, target, and maximum amounts, as well as the actual achievement, with respect to each goal. Achievement of goals between each of the levels was measured on a straight-line interpolation basis, and the corresponding payment was likewise determined on a corresponding straight-line interpolation basis.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Threshold | | Target | | Maximum | | Actual |

| Goal | | Achievement | | Payout | | Achievement | | Payout | | Achievement | | Payout | | Achievement | | Payout |

Financial goals(1) | | | | | | | | | | | | | | | | |

| Real estate services revenue | | $ | 781,450 | | | 0 | % | | $ | 903,265 | | | 35.0 | % | | $ | 970,300 | | | 52.5 | % | | $ | 903,334 | | | 35.0 | % |

| Properties revenue | | $ | 440,341 | | | 0 | % | | $ | 719,502 | | | 5.0 | % | | $ | 800,000 | | | 7.5 | % | | $ | 880,653 | | | 7.5 | % |

| Other revenue | | $ | 51,160 | | | 0 | % | | $ | 61,160 | | | 10.0 | % | | $ | 71,160 | | | 15.0 | % | | $ | 33,426 | | | 0.0 | % |

Net loss(2) | | $ | (33,460) | | | 0 | % | | $ | (13,460) | | | 25.0 | % | | $ | 0 | | | 37.5 | % | | $ | (58,683) | | | 0.0 | % |

| Financial goals subtotal | | | | 0 | % | | | | 75.0 | % | | | | 112.5 | % | | | | 42.5 | % |

| Diversity goals - company wide | | | | | | | | | | | | | | | | |

| Field individual contributors | | 32.0 | % | | 0 | % | | 33.5 | % | | 6.25 | % | | 34.2 | % | | 9.38 | % | | 35.6 | % | | 9.38 | % |

| Field managers | | 25.4 | % | | 0 | % | | 28.2 | % | | 6.25 | % | | 29.4 | % | | 9.38 | % | | 24.2 | % | | 0.0 | % |

| Headquarters individual contributors | | 12.6 | % | | 0 | % | | 13.0 | % | | 6.25 | % | | 13.6 | % | | 9.38 | % | | 14.8 | % | | 9.38 | % |

| Headquarters managers | | 26.7 | % | | 0 | % | | 29.8 | % | | 6.25 | % | | 30.4 | % | | 9.38 | % | | 36.0 | % | | 9.38 | % |

| Diversity goals - company wide - subtotal | | | | 0 | % | | | | 25.0 | % | | | | 37.5 | % | | | | 28.1 | % |

| Diversity goals - field | | | | | | | | | | | | | | | | |

| Diversity: field individual contributors | | 32.0 | % | | 0 | % | | 33.5 | % | | 12.5 | % | | 34.2 | % | | 18.75 | % | | 35.6 | % | | 18.75 |

| Diversity: field managers | | 25.4 | % | | 0 | % | | 28.2 | % | | 12.5 | % | | 29.4 | % | | 18.75 | % | | 24.2 | % | | 0 | % |

| Diversity goals - field - subtotal | | | | 0 | % | | | | 25.0 | % | | | | 37.5 | % | | | | 18.75 |

| Diversity goals - headquarters | | | | | | | | | | | | | | | | |

| Headquarters individual contributors | | 12.6 | % | | 0 | % | | 13.0 | % | | 12.5 | % | | 13.6 | % | | 18.75 | % | | 14.8 | % | | 18.75 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Headquarters managers | | 26.7 | % | | 0 | % | | 29.8 | % | | 12.5 | % | | 30.4 | % | | 18.75 | % | | 36.0 | % | | 18.75 | % |

| Diversity goals - headquarters - subtotal | | | | 0 | % | | | | 25.0 | % | | | | 37.5 | % | | | | 37.5 | % |

(1) All financial goals are reported in thousands of dollars.

(2) Actual net loss of $58,683 reflects our net loss of $109,613, as reported in our 2021 audited financial statements, adjusted to exclude (i) $43,067 of loss attributable to RentPath following our acquisition on April 2, 2021 and (ii) $7,863 of one-time transaction expenses associated with our acquisition of RentPath.

Target Equity Compensation

Other than for Mr. Kelman, the equity component of an NEO's target total direct compensation consisted of (i) time-based RSU awards that vest into shares of our common stock dependent on the NEO's continued service with us and (ii) PSU awards that are earned and settle into shares of our common stock dependent on (A) our achievement of three pre-established performance objectives, each of which can be achieved independently of the other two, and (B) the NEO's continued service with us. For Mr. Kelman, our compensation committee did not grant him any equity compensation in light of Mr. Kelman's request to again not receive any equity in 2021. The committee also considered (i) the performance-based stock options granted to Mr. Kelman in 2019 that have a performance condition spanning from 2019 through 2021 and (ii) Mr. Kelman's existing equity ownership in our company. The committee believed that these two factors appropriately incentivized Mr. Kelman in 2021 without further equity compensation.

The table below sets forth our NEOs' target equity compensation for 2021, compared to 2020.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 2020 equity compensation | | 2021 equity compensation |

| NEO | | RSU award(1) | | PSU award(1) | | Target equity compensation | | RSU award(1) | | PSU award(1) | | Target equity compensation |

| Chris Nielsen | | $ | 625,000 | | | $ | 625,000 | | | $ | 1,250,000 | | | $ | 785,000 | | | $ | 785,000 | | | $ | 1,570,000 | |

Ee Lyn Khoo(2) | | N/A | | N/A | | N/A | | $ | 450,000 | | | $ | 450,000 | | | $ | 900,000 | |

| Adam Wiener | | $ | 725,000 | | | $ | 725,000 | | | $ | 1,450,000 | | | $ | 1,050,000 | | | $ | 1,050,000 | | | $ | 2,100,000 | |

| Bridget Frey | | $ | 700,000 | | | $ | 700,000 | | | $ | 1,400,000 | | | $ | 800,000 | | | $ | 800,000 | | | $ | 1,600,000 | |

(1) Our compensation committee granted RSUs and PSUs based on the dollar values in the table. To determine the number of shares underlying these awards, we converted the dollar value of the award into a number based on the average closing price of our common stock for the 30 trading days prior to the date of our compensation committee's approval of the grant.

(2) The amounts in the table for Ms. Khoo represent the grants to her in connection with our annual executive compensation review. Ms. Khoo also received $1,450,000 in equity awards in connection with her offer to join our company, as discussed below under "—Ms. Khoo's 2021 Compensation."

In setting our NEOs' target equity compensation, our compensation committee considered the factors described under "Our Considerations in Setting NEO Compensation" above, including looking at the peer group data to gain an understanding of target equity compensation for our compensation peers' executives. The committee also sought to grant RSUs and PSUs in equal proportions to balance the three considerations of driving specific company performance goals, alignment with our stockholders' interests, and retention.

RSU award. One quarter of each NEO's 2021 RSU award will vest on May 20, 2022 and one sixteenth of the award will vest quarterly thereafter, such that the entire award will be vested by May 20, 2025, subject to the NEO's continued service on each applicable vesting date.

PSU award. Each PSU award has three performance objectives, and each objective can be achieved independently of the other two. The dollar value of each NEO's PSU award described in the table above, and the corresponding number of PSUs, reflect the target number of PSUs granted. This target number is equally allocated among the three performance objectives. For each objective, the actual number of PSUs that may be earned and settle into shares of our common stock will depend on our achievement of that objective.

Each performance objective has threshold, target, and maximum levels, with achievement resulting in 25%, 100%, and 200%, respectively, of the target number of PSUs for that objective being earned. If we achieve below the threshold level for an objective, then no PSUs allocated to that objective will be earned. Achievement between each of the levels will be measured on a straight-line interpolation basis, and the corresponding number of PSUs will likewise be determined on a corresponding straight-line interpolation basis. Any PSUs that are earned at the end of the three-year performance period will vest and settle into shares of our common stock upon the committee's certification of the achievement level.

The table below describes the three performance objectives for our 2021 PSU awards.

| | | | | | | | | | | | | | |

| Performance objective | | Performance period | | What it measures |

| Aggregate gross profit | | January 1, 2021 - December 31, 2023 | | Our progress on our drive towards profitability |

| Market share | | January 1, 2023 - December 31, 2023 | | Our ability to grow our real estate services business |

| Relative total shareholder return (TSR) | | June 1, 2021 - December 31, 2023 | | Our achievement of long-term investment returns for our shareholders |

Aggregate gross profit. Our aggregate gross profit for the three-year performance period is the sum of the gross profit reported in our annual report for each of the three years and as calculated in accordance with U.S. Generally Accepted Accounting Principles.

Market share. Market share is our U.S. market share by value for 2023, as reported in our 2023 annual report. We calculate our market share by aggregating the home value of brokerage transactions and our partner transactions, which we collectively refer to as real estate services transactions. Then, in order to account for both the sell- and buy-side components of each transaction, we divide that value by two-times the estimated aggregate value of U.S. home sales. We calculate the aggregate value of U.S. home sales by multiplying the total number of U.S. existing home sales by the mean sale price of these homes, each as reported by the National Association of REALTORS®.

Relative total shareholder return (TSR). Relative TSR measures the change in our stock price relative to the change in stock prices for companies in the S&P 400 MidCap Index, or S&P 400 (in each case, adjusted to reflect any reinvested dividends). We will determine the change in stock price based on the average closing price for the 30 trading days at the end of the performance period relative to the same period immediately preceding the commencement of the performance period. Only companies that were part of the S&P 400 at the beginning of the performance period and that remain publicly traded at the end of the performance period will be considered. The beginning of the performance period - June 1, 2021 - represents the grant date for our 2021 PSU awards.

Ms. Khoo's 2021 Compensation

Ms. Khoo joined us as chief human resources officer in January 2021. Due to her beginning employment with us early in the year, she received two compensation packages during 2021 - one in connection with her joining our company and one as part of our annual executive compensation review. Our compensation committee approved both packages. When approving our offer to Ms. Khoo to join our

company, the committee reviewed market data from Compensia and considered various factors, including: (i) the competitive landscape for recruiting a chief human resources officer; (ii) the potential appreciation of our stock price relative to other possible employers for Ms. Khoo, and (iii) the compensation of our other executive officers and internal pay equity.

Upon joining our company, Ms. Khoo's base salary and target payout under our executive bonus was $350,000 and $200,000, respectively. These amounts did not change in connection with our annual executive compensation review. As part of Ms.Khoo's employment offer, we agreed to pay Ms. Khoo a $1,050,000 signing bonus in two installments. We paid the first installment of $650,000 in January 2021. Ms. Khoo's employment with us ended in January 2022, before she was due to be paid the second installment of her signing bonus, as well as the amount that she had earned under our 2021 executive bonus plan.

As part of the offer for Ms. Khoo to join our company, we granted her an RSU award having an aggregate value of $1,000,000 and a PSU award having a target aggregate value of $450,000 in March 2022, which was during the first open trading window to grant employee equity awards after Ms. Khoo's start date. We converted the dollar value of the award into a number based on the average closing price of our common stock for the 30 trading days prior to the date of our compensation committee's approval of the grant. The RSU award was scheduled to vest over four years, following our standard vesting schedule for new employees' RSU awards. The performance objectives for the PSU award matched those of the PSU awards granted to our executives in December 2020.

During our annual executive compensation review, Ms. Khoo received additional RSU and PSU awards, each having an aggregate market value of $450,000, as described above under "—Elements of Our NEOs' Direct Compensation—Target Equity Compensation."

Results of PSUs and Performance Stock Options Granted in 2019

In 2019, we granted PSUs to our executives other than Mr. Kelman, and performance stock options to Mr. Kelman, that would be earned based on our aggregate gross profit from 2019 through 2021, as calculated in accordance with U.S. Generally Accepted Accounting Principles and reported in our audited financial statements for each individual year. Each executive would earn a percentage of his or her target PSUs and stock options, as applicable, based on our aggregate gross profit, as set forth in the table below. Our aggregate gross profit was $780,033,137. Accordingly, each executive who received a 2019 PSU award (which includes each NEO other than Mr. Kelman and Ms. Khoo) and Mr. Kelman, with respect to his performance stock options, received 200% of the award's target amount, with such awards vesting in full in February 2022 upon our compensation committee's certification of the gross profit achievement level.

| | | | | | | | | | | | | | |

| Aggregate gross profit achievement level | | PSUs earned as a percentage of target number | |

| ≥$478,000,000 | | 25% | |

| ≥$628,000,000 | | 100% | |

| ≥$698,000,000 | | 200% | |

Other Benefits Available to Our NEOs

In addition to the elements of direct compensation described above, our NEOs are also eligible to receive other standard employee benefits. Consistent with our culture of thrift, we do not offer our NEOs any benefit that is unavailable on the same basis to our other full-time employees. The most significant of these benefits include (i) health and life insurance coverage, (ii) paid-time off, (iii) the opportunity to purchase shares of our common stock at a discount pursuant to our 2017 Employee Stock Purchase Plan, (iv) the ability to contribute to a 401(k) retirement plan, including a company match of up to $2,000

on contributions beginning in 2022, and (v) the opportunity to purchase transit and parking using pre-tax dollars.

Agreements with Our NEOs

We do not have an employment agreement with any of our NEOs, but we have entered into employment offer letters with each NEO. Pursuant to these offer letters, each NEO is an "at-will" employee, receives a base salary, has the opportunity to earn an incentive bonus under our executive bonus plan, and is eligible to receive our standard employee benefits.

We have entered into a change in control and severance agreement with each of our NEOs that provides for payments and benefits to the NEO upon a qualifying termination of employment in connection with a change in control. Please see "Potential Payments upon Termination or Change in Control—Change in Control Severance Agreement" below for more information.

Share Ownership and Anti-Hedging Policies

We have adopted a share ownership policy that requires each NEO to beneficially own a minimum dollar value of our common stock, after being an executive officer for four years. We also prohibit each NEO from purchasing any financial instrument, or otherwise engage in transactions, that hedge or offset, or are designed to hedge or offset, any decrease in the value of our common stock owned by the NEO. For more information about these policies, please see "Our Corporate Governance" below.

Certain Tax and Accounting Impacts of Our NEO Compensation

The Tax Cuts and Jobs Acts of 2017 amended a tax law that governed whether we can deduct certain types of compensation paid to an NEO that exceeds $1,000,000 for any year. For this purpose, compensation is based on tax laws and is not necessarily the same as the amount reported for an NEO in the Summary Compensation Table below. Because of uncertainties in the interpretation and implementation of the amendment, there is no guaranty on whether we will be able to fully deduct our NEOs' compensation.

We record compensation expense for the equity awards granted to our NEOs based on the grant date fair value of the awards, and we recognize the expense over the service period for the award. We determine both the grant date fair value and the service period based on accounting standards. To the extent an NEO forfeits his or her award or we determine that the probable outcome of the PSU award's performance condition is no longer the same as it was on the grant date, then we will adjust, in the period of the forfeiture or determination, the previously recognized expense.

Compensation Committee Report

The compensation committee has reviewed and discussed with management the section entitled "Compensation Discussion and Analysis" above. Based on this review and discussion, the compensation committee recommended to Redfin's board of directors that the "Compensation Discussion and Analysis" section be included in this proxy statement.

James Slavet

Kerry D. Chandler

Selina Tobaccowala

Summary Compensation Table

The following table provides information regarding our NEOs' compensation for 2021, 2020, and 2019.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Name and

principal position | | Year | | Salary

($) | | Bonus

($) | | Stock awards(2)(3) ($) | | Option awards(3)(4)

($) | | Non-equity incentive plan compensation(5)

($) | | Total

($) |

Glenn Kelman

(chief executive officer) | | 2021 | | 299,341 | | | — | | — | | | — | | | — | | | 299,341 | |

| 2020 | | 63,132 | | | 477 | | — | | | — | | | — | | | 63,609 | |

| 2019 | | 284,368 | | | — | | — | | | 797,915 | | | — | | | 1,082,283 | |

Chris Nielsen

(chief financial officer) | | 2021 | | 501,374 | | | — | | 1,616,354 | | | — | | | 160,000 | | | 2,277,728 | |

| 2020 | | 470,275 | | | 477 | | 1,486,497 | | | — | | | — | | | 1,957,249 | |

| 2019 | | 418,324 | | | — | | 1,107,790 | | | — | | | 109,904 | | | 1,636,018 | |

Ee Lyn Khoo(1) (chief human resources officer) | | 2021 | | 342,308 | | | 650,000 | | 2,022,661 | | | — | | | 141,200 | | | 3,156,169 | |

Adam Wiener

(president of real estate operations) | | 2021 | | 401,099 | | | — | | 2,162,070 | | | — | | | 122,600 | | | 2,685,769 | |

| 2020 | | 396,044 | | | 477 | | 1,724,318 | | | — | | | — | | | 2,120,839 | |

| 2019 | | 368,187 | | | — | | 1,329,348 | | | — | | | 109,904 | | | 1,807,439 | |

Bridget Frey